ElevenLabs ARR Hit $330M, Checkr Hit $800M

The "AI+Figma for Hardware Design" Grows With ARR Curve That Looks Unreal

ElevenLabs ARR hit $330M

ElevenLabs officially announced that its ARR has surpassed $330 million.

According to CEO Mati Staniszewski, ElevenLabs reached its first $100M in ARR in 20 months, grew from $100M to $200M in 10 months, and then jumped from $200M to $330M in just five months. The growth curve isn’t just steep — it’s clearly accelerating.

Enterprise customers now account for nearly half of total revenue, and they represent the fastest-growing segment. In voice-based customer support automation alone, ElevenLabs processes more than 50,000 inbound and outbound calls per month. Customers include Deutsche Telekom, Toyota, and fast-growing startups like Harvey and Lovable.

ElevenLabs is already operating at an EBITDA margin of ~60%. Its core strategy is deliberately “two-handed”: deep investment in foundational infrastructure and research, while simultaneously building end-user applications and deployment-ready products.

When ElevenLabs crossed $200M ARR, Mati noted that in the AI era, valuation ultimately anchors to growth and revenue — not narratives.

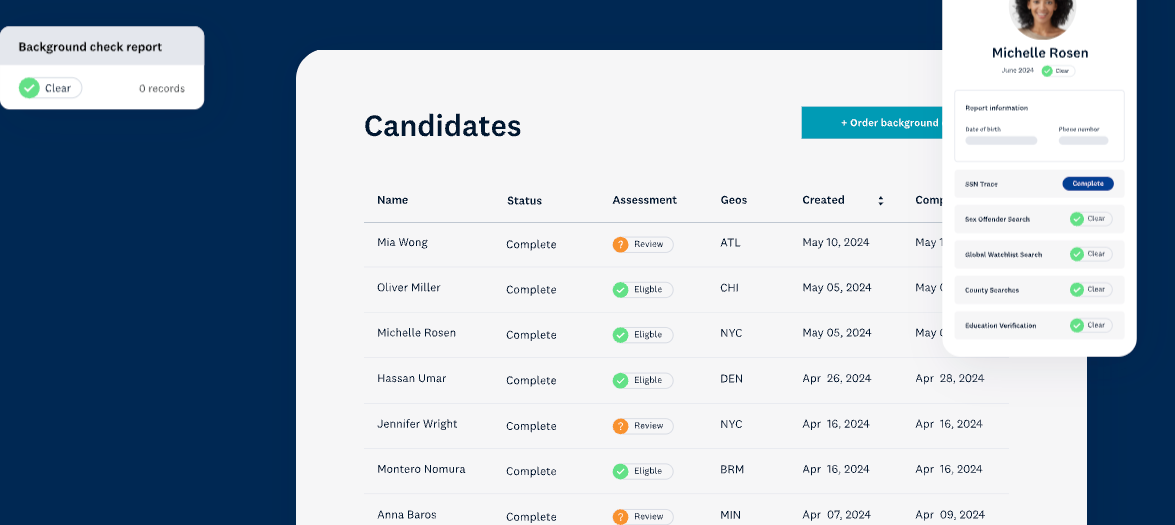

Checkr hit $800M Revenue

Checkr, which started as a background check company, has grown its annual revenue to $800 million — and may be entering a new growth phase.

Checkr originally built its business verifying criminal records for Uber drivers and gig workers. But in the generative AI era, founder Daniel Yanisse sees a new wave of white-collar fraud, increasingly powered by AI, driving demand for the company’s services.

Across job and loan applications reviewed by Checkr, at least 40% contain inaccurate or falsified employment or financial information. Fraudsters are now using tools like ChatGPT and Google Gemini to generate increasingly realistic fake documents, including pay stubs and employment records.

This year, Checkr has also observed large-scale AI-driven hiring fraud — from fabricated resumes to fully synthetic work histories. Demand is rising rapidly across both SMBs and Fortune 500 companies.

As Yanisse put it, “The need to verify identity and credentials has never been higher.” Fueled by surging demand for white-collar employment verification, Checkr’s revenue grew from $700M in 2024 to $800M today.

A Common Pattern: Authenticity Verification is a Big Business in the AI-generated Era

These developments remind me of two AI I recently covered.

The first is the AI detection tool built by 2 colleges, initially designed to help teachers identify AI-generated essays.

Over time, it evolved beyond detection into a broader platform for writing assistance, enterprise content compliance, and even training-data cleaning for AI companies themselves.

By moving from a defensive use case to an empowering one, the company expanded its TAM by orders of magnitude and crossed $24M ARR.

The second is the AI-powered customer research platform Listen Labs, which grew revenue 15x in a single year by automating qualitative research at scale.

Its most important (and least visible) moat is anti-fraud technology — solving the problem of how to prove what’s real in an era flooded with synthetic data, and do so in a verifiable way.

After achieving rapid revenue growth, the company today announced a Series B, bringing total funding to $100M, and has now conducted AI-mediated interviews with over one million people.

The “AI+Figma for Hardware Design” Grows With ARR Curve That Looks Unreal

At the same time, an AI product that may fundamentally reshape the hardware design industry is quietly taking off. Over the past six months, its revenue curve has begun to look almost like a straight line.

Its trajectory is strikingly similar to Figma’s.