a16z Raises $15B — No Longer Just a VC, An AI Detection Tool Hit $24M ARR Built by 2 colleges

a16z accounts for nearly one-fifth of all U.S. VC capital raised in 2025

Andreessen Horowitz (a16z) officially announced the close of its latest $15 billion fund — significantly higher than the widely rumored $10 billion.

With this raise, a16z’s total assets under management have reached roughly $90 billion. The new capital is spread across multiple strategy-specific funds, with a heavy concentration in growth and late-stage investments.

What’s more striking is the context.

2025 is shaping up to be one of the weakest years for VC fundraising in the U.S., yet a16z reportedly closed this massive round in just three months. That speed alone signals the extent to which LPs still place confidence in the firm.

At this scale, a16z now accounts for nearly one-fifth of all U.S. VC capital raised in 2025, surpassing even Lightspeed’s $9B raise last December. Four of its sub-funds now rank among the largest VC funds ever raised.

There’s long been a belief in venture that “bigger funds mean lower returns.” But according to previously leaked internal materials, a16z has generated over $25 billion in net profits for LPs since its founding in 2009.

Not Boring’s recent analysis also highlights that a16z backs a large share of the world’s most valuable private companies — including OpenAI, SpaceX, xAI, Databricks, Stripe, and others. In AI alone, companies backed by a16z represent roughly 44% of total AI unicorn value.

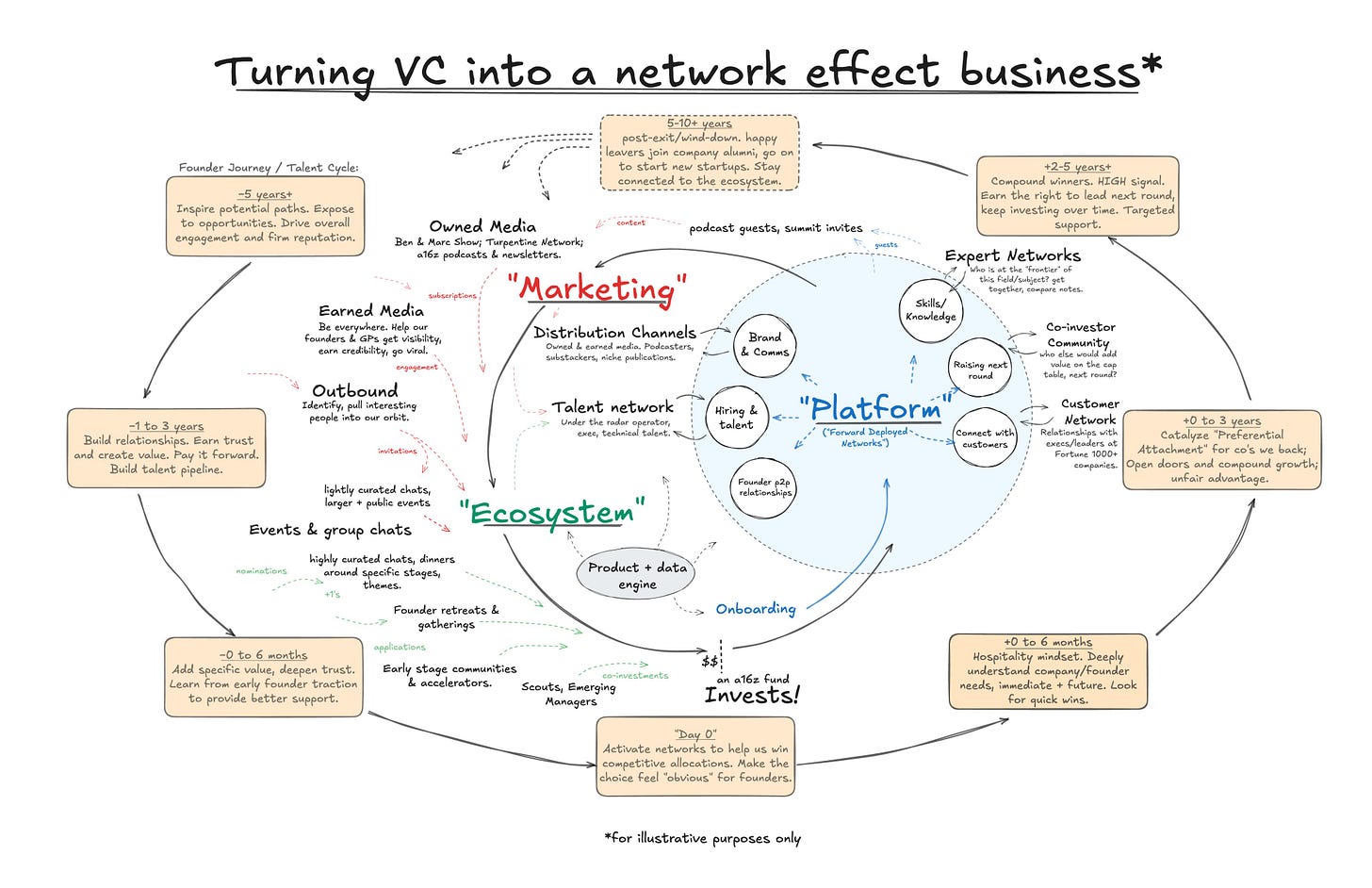

a16z Is No Longer Just a Fund

After the raise, Not Boring published a deep dive titled “a16z: The Power Brokers.”

Its core argument is simple but sharp: a16z is no longer just a venture fund — it’s a firm designed to shape the future of technology.

Traditional VC funds optimize for financial return cycles. a16z, by contrast, positions itself as a long-term institution focused on influence, scale, and technological leverage. Capital is merely the tool; shaping what the future looks like is the real objective.

Ben Horowitz summarized this philosophy clearly in the firm’s official blog:

At a16z, we believe that the best thing that a society can do for a person is to give them a chance. Give them a shot at a great life regardless of their circumstance, background, ethnicity, religion, gender or any other attribute. Give them a shot, a chance to contribute, a chance to do something larger than themself and make the world a better place. That’s the best we can do.

Here’s what I mean by “giving everybody a shot.” It doesn’t mean what it meant in Communist societies, when “an equally fair shot” ultimately resulted in no one getting a shot at all. It means that you have a chance to create opportunities for yourself and for others. This is why even if it is not totally fair, giving people a shot is a profound accomplishment for society and humanity. It is the gift that keeps on giving. The more people that take that chance and do something great, the better the world becomes for all of us.

Packy McCormick draws a key distinction:

A Fund exists to deploy capital for profit.

A Firm exists to build enduring competitive advantage, influence, and momentum.

a16z doesn’t merely follow markets — it decides what the future should look like, then funds it aggressively.

That mindset shows up in how they invest:

Elephant hunting: Fewer bets, much bigger outcomes.

Conviction over time: Doubling down on winners rather than spreading thin.

Trend alignment: Staying relentlessly focused on where technology is heading.

Databricks is a classic example. What started as an academic open-source project at UC Berkeley became a company only because a16z insisted the founders go all-in — and backed that belief with a $10M check when the team initially asked for just $200K.

Years later, even when revenue was tiny and conviction was scarce, a16z remained the strongest believer.

As Packy put it: belief is powerful — especially when you have the resources to make it self-fulfilling.

An AI Detection Tool Hit $24M ARR: From “Catching Cheaters” to Teaching Writing:

After the emergence of generative AI, one of the earliest product categories to develop was AI detection. Many companies rushed in — but most stalled.

The few that truly broke out all did something counterintuitive: