VC's Kingmaking strategy: Harvey has raised $760M in this year alone

What made Higgsfield Breaks $100M ARR in 18 months

Claude Code ARR Hit $1B in 6 months

Claude Code — the AI coding assistant from Anthropic — has achieved a remarkable milestone of $1 billion in annualized revenue run-rate (ARR) within roughly six months of its public release in May 2025. This rapid growth underscores how quickly enterprise adoption has ramped up for AI-assisted development tools in 2025.

Claude Code provides developers and engineering teams an AI-powered coding environment that automates many aspects of software creation: from code generation, bundling, runtime, package management, to testing — dramatically streamlining workflows.

Its recent acquisition of Bun — a high-performance JavaScript/TypeScript runtime bundler, package manager, and test runner — is intended to boost performance, stability, and developer experience, making Claude Code more efficient and reliable as usage scales.

Anthropic’s strategic acquisition of Bun signals a commitment to own the full stack of AI-powered developer tooling — not just the language model. The underlying infrastructure now supports enterprise customers including big names like Netflix, Spotify, Salesforce, KPMG and more.

This consolidation strengthens Anthropic’s position in the AI tooling market, ensuring tight integration, performance optimization, and long-term control over the product’s technical foundation.

VC’s Kingmaking strategy: Harvey has raised $760M in just this year alone

Legal AI company Harvey has just raised another $160 million, led by a16z, pushing its valuation to $8 billion.

This marks Harvey’s third fundraising round in 2024, bringing its total to $760 million—making it one of the most heavily funded companies in legal AI. Earlier this year, it secured $300M led by Sequoia in January (at a $3B valuation) and another $300M led by KP in June (at a $5B valuation). Now a16z’s $160M round pushes it to $8B.

By August, Harvey had already reached $100M ARR, as noted in my earlier post.

TechCrunch has called Harvey a textbook case of VC “kingmaking”—where investors pour massive sums into AI startups to project stability, giving enterprise customers (like law firms) the confidence to sign large contracts, creating a self-fulfilling prophecy.

In one article, TC describes a growing VC strategy: manufacturing a winner early by deploying outsized capital relative to revenue, creating a perception of market dominance to overwhelm competitors. This “extreme valuation vs. revenue” pattern is becoming increasingly common among top-tier funds.

The AI ERP space offers another example. Recently, a new entrant DualEntry raised a $90M Series A at a $450M valuation, led by Lightspeed and Khosla—even though its ARR is reportedly only $400k. Its competitors Rillet and Campfire quickly raised multiple rounds as well.

In the previous tech cycle, such tactics mostly happened in late-stage battles (e.g., Uber vs. Lyft). But in the AI era, capital-as-a-weapon is moving earlier and earlier.

The same feeling applies to AI image/video generation. Black Forest Labs (BFL) hit a $3.25B valuation within one year of founding.

But there is some different in this category, revenue has also been growing just as fast—BFL reached $100M ARR within its first year.

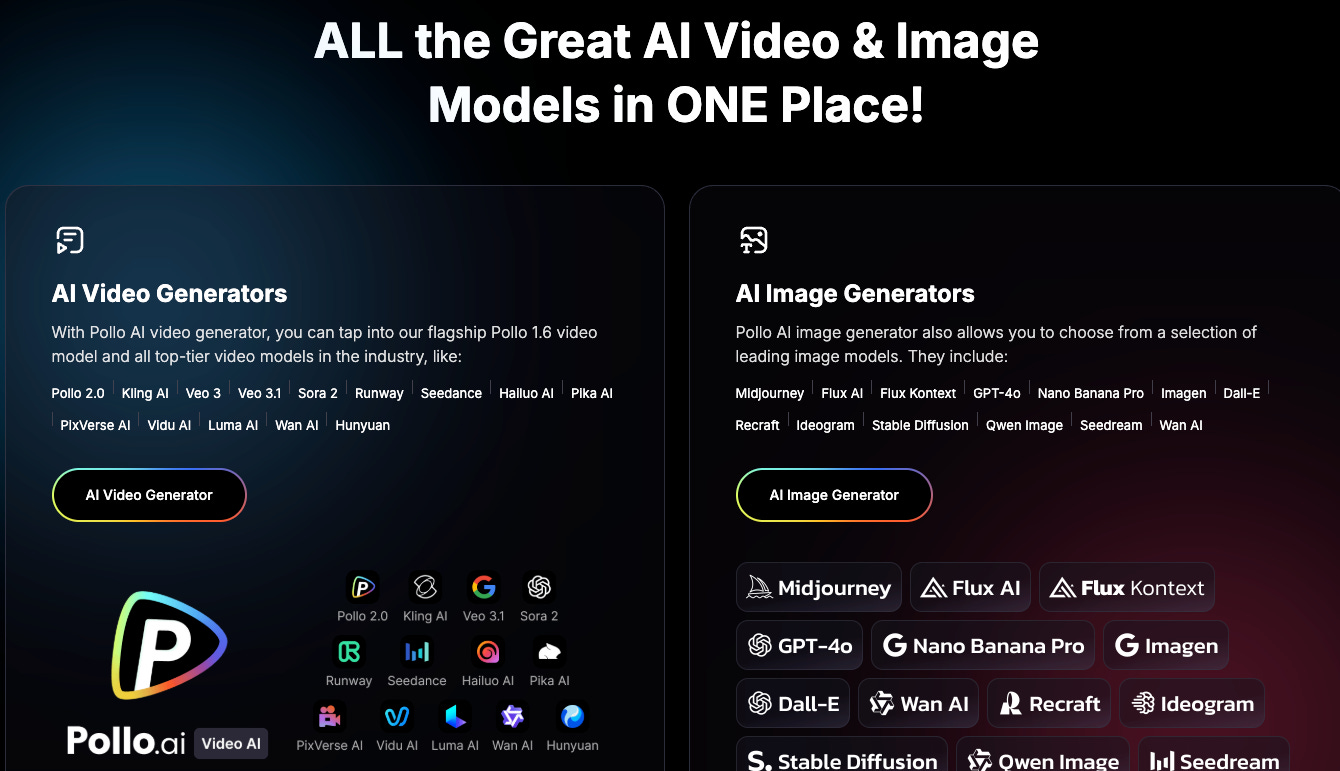

In China, Pollo AI officially announced its first $14M funding round yesterday—along with $20M+ ARR.

According to founder and CEO, Pollo already has 20M registered users, 6M MAU, 200k DAU, and became profitable in May, despite launching only at the end of last year. That’s remarkable speed.

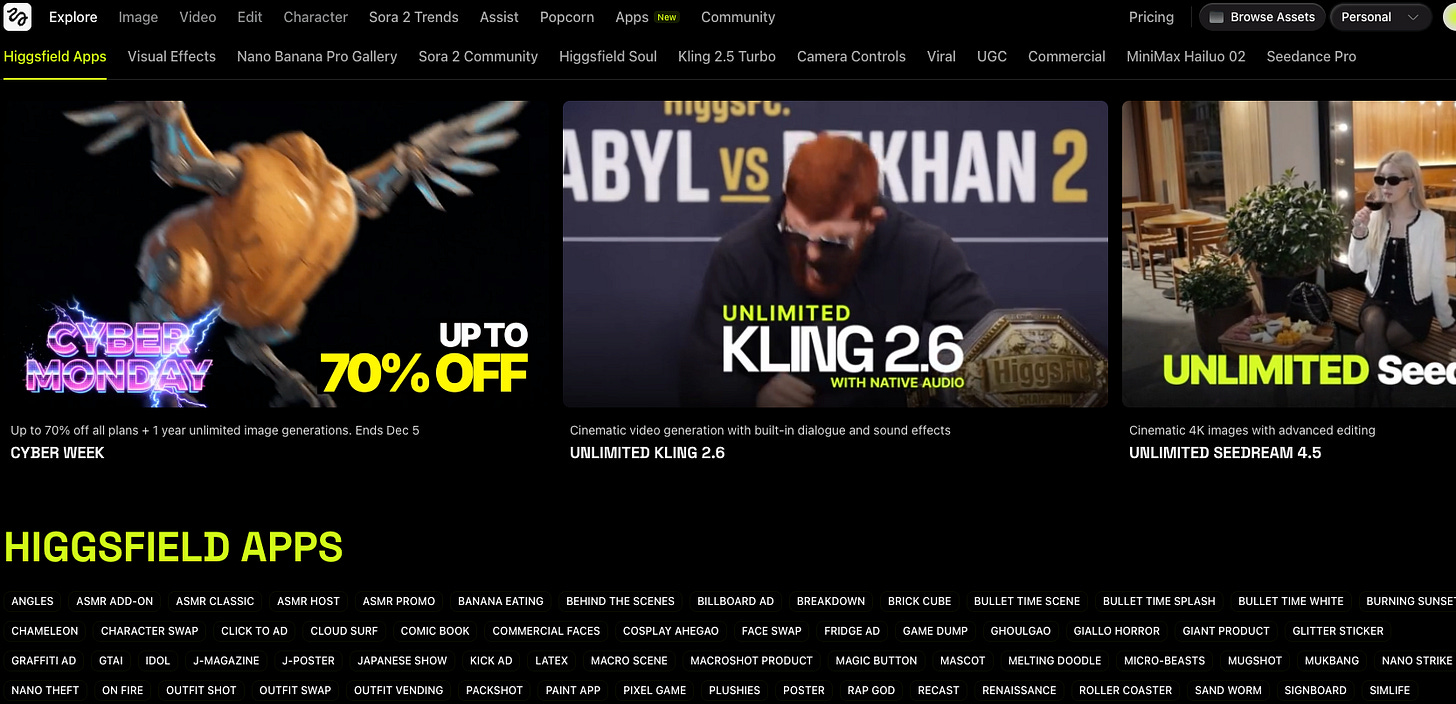

Meanwhile, another AI image/video platform, Higgsfield, announced it has crossed $100M ARR, and generated $1M in sales on Black Friday alone.

When Higgsfield raised $50M in September, it claimed to be the fastest company ever to grow from $1M to $100M ARR. Later they adjusted the number to a $50M run rate, but now Stripe has confirmed the revenue.

Higgsfield has particularly impressed me with its insane social media reach—1.2 billion impressions by September.

The origin story: why Higgsfield was created

The idea dates back to founder Mashrabov’s time as Director of Generative AI at Snap. He noticed:

Video is the most expensive but most impactful content format.

U.S. adults spend ~3 hours/day watching online video, yet creating one minute of pro-quality video often costs thousands of dollars and takes weeks.

Early AI video tools targeted the wrong users.

When OpenAI launched Sora in early 2024, it was aimed at well-funded creative professionals—not everyday creators, marketers, or brand teams.

Text-to-video required complex prompts; image-to-video required curated assets. The barrier was too high.

So he left Snap and co-founded Higgsfield AI with Yerzat Dulat (CTO) and Mahi de Silva. Their first product, Diffuse, was a mobile AI video app enabling users to create and share short videos of themselves and friends.

Its core features included:

50+ cinematic camera presets: dolly, pan, orbit, Dutch angle, FPV drone, etc.

Realistic human generation: improved facial expressions, body motion, environment interaction

Built-in audio/soundtrack generation: synchronized dialogue, music, SFX

The response exceeded expectations: within two months (Apr–Jun 2024) Diffuse hit 2M MAU, 600k peak DAU, and $11M ARR.

Quickly expanding into a product matrix

They launched multiple products targeting different user tiers:

Web Studio — full creator dashboard (drag-and-drop images, camera presets, parameter control, live preview)

Higgsfield Ads — 1-click ad generator turning product images into 30+ ad templates

UGC Factory — large-scale creator-style content for e-commerce teams

Soul UGC Builder — multi-shot storyboard creation for branded content

Popcorn — storyboard tool maintaining character/lighting/style consistency

This matrix covers the entire value chain—from casual creators to professional marketing teams.