Turning $150K Into $700M in 6 Years: How Kalshi Is Rebuilding Finance Through Prediction Markets

Not only financial innovation but part of a larger information revolution

Kalshi, the leading prediction market, has raised yet another massive round—this time a staggering $1 billion, pushing its valuation to $11 billion. Back in October, Kalshi had just closed a $300 million round at a $5 billion valuation.

In June, Kalshi had completed its $185 million Series C at a $2 billion valuation. In just six months, its valuation jumped from $2B to $11B—a 5.5x increase.

Paradigm co-founder Matt Huang said Paradigm has invested in Kalshi for three consecutive rounds this year, calling it one of the fastest-growing companies they’ve ever seen.

He described prediction markets as “truth-revealing machines at a civilizational scale” and a broad search for the financial exposures society wants—similar to how YouTube became a broad search mechanism for media.

This rapid valuation surge has not only made co-founder Luana Lopes Lara one of the youngest female billionaires in history—it also turned YC’s $150,000 investment from six years ago into nearly $700 million (somewhat diluted but likely to grow further).

Freda Duan, partner at Altimeter Capital, previously wrote that prediction markets are blurring the line between “information” and “assets.”

So how exactly did Kalshi get here? How did it start, what obstacles did it face, what unlocked this explosive growth over the past year, and where are its biggest future opportunities?

This article digs deeper into how Kalshi is using prediction markets to reshape global finance.

Founders Forged in War and Ballet

Kalshi co-founder Tarek Mansour was born in Lebanon and witnessed the 2007 Lebanon conflict firsthand. The experience taught him that the world is full of uncertainty—and those who can manage it can shape their destiny. He taught himself English, studied for the SAT, and ultimately entered MIT, majoring in electrical engineering, computer science, and mathematics.

Co-founder Luana Lopes Lara also had an unusual upbringing. She trained at a brutal ballet school in Brazil—teachers would literally light cigarettes under her thigh to test how long she could hold her leg up without getting burned. Classmates would hide glass shards in each other’s ballet shoes. The experience forged her exceptional resilience and an immunity to rejection—traits that later proved crucial in regulatory battles.

After high school, she spent nine months as a professional ballet dancer in an Austrian theater. But her dream was to become the next Steve Jobs. Inspired by her mother, a math teacher, and her father, an electrical engineer, she won two Olympiad medals and in 2015 received her acceptance letter from MIT.

The Idea Born on Wall Street

In the summer of 2016, Mansour interned on Goldman Sachs’ equity derivatives team during the Brexit referendum. He saw institutions scrambling to hedge Brexit risk using complex, expensive, and imperfect structured products. He wondered: Why isn’t there an exchange where the underlying asset is the event itself? After all, events are the most real thing we all experience.

Meanwhile, Lopes Lara interned at Bridgewater Associates (Ray Dalio) and Citadel (Ken Griffin). Mansour also worked as a global macro trader at Citadel.

At MIT, both studied computer science. Lopes Lara always sat in the front row; Mansour started sitting beside her to learn from her.

In 2018, both interned at Five Rings Capital in New York. One night, walking home, the idea crystallized: Why can’t you trade directly on the outcomes of events? Why must investors rely on indirect instruments like stocks or bonds to express views about the future?

As Mansour put it:

Most trading begins with a view of the future, and then people search for a way to express that view.

Bringing the Idea to YC

In 2019, they graduated from MIT and applied to YC with this seemingly crazy concept—and got accepted. But reality quickly hit. Prediction markets sat in a legal gray zone in the U.S.

They discovered they needed federal approval to operate legally. They contacted 40+ law firms; none would take the case—the founders were too young, the company too small, and the risk too high.

“We had just graduated from college and were taking enormous risks,” Lopes Lara told Forbes. “For two years we had no product—nothing—and if we didn’t get regulatory approval, the company would go to zero.”

During the 2020 pandemic, she worked remotely in London while Mansour returned to Lebanon—where he experienced the deadly Beirut port explosion that killed over 200 people. He spent his days helping clean debris and search for survivors, and his nights working on Kalshi.

The turning point arrived with Jeff Bandman, a former CFTC official and the only lawyer willing to help. Under his guidance, Kalshi began an 18-month regulatory approval process.

On November 4, 2020, Kalshi received CFTC approval, becoming the first federally regulated exchange for event contracts in U.S. history—essentially creating and legalizing a brand-new asset class.

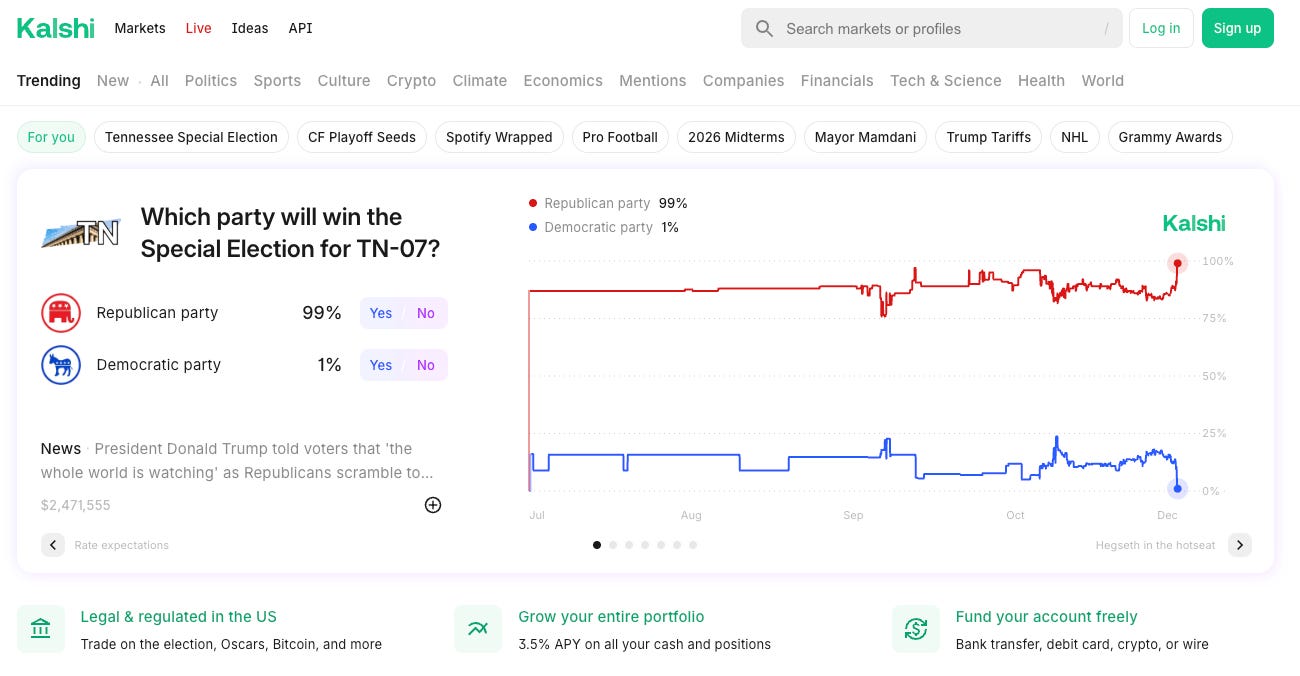

Kalshi launched in July 2021. Early markets were dull—“Will NYC indoor dining close?”, “Will CPI rise above 0.4%?”, “Will recession start this year?” Trading volumes remained low at $20–30M monthly.

The real opportunity was elections. In June 2023, Kalshi applied to launch markets on U.S. congressional control. The CFTC rejected it as “gambling.” This was catastrophic—elections are the most liquid, high-demand prediction markets.

Every investor advised against suing the regulator. But Lopes Lara made the bold call: sue the CFTC.

A Historic Legal Victory in September 2024

In late 2023, Kalshi sued the CFTC. In September 2024, a federal district judge ruled in Kalshi’s favor, saying the CFTC overstepped its authority. On October 2, a federal appeals court upheld the ruling, allowing Kalshi to relaunch election contracts.

Kalshi became the first regulated U.S. election market in over a century. Lopes Lara said they insisted on doing things legally because their vision was to build the world’s largest financial exchange—and legality was non-negotiable.

The Exponential Breakout Moment: The 2024 Election

The 2024 U.S. presidential election became Kalshi’s watershed moment. Users wagered more than $500 million on candidates before election day. Kalshi markets predicted Trump’s victory a month before the election. On election day, trading volume hit $245 million in a single day.

Explosive growth followed:

2023 revenue: $1.8M

2024 revenue: $24M (up 1,220%)

2023 trading volume: $183M

2024 trading volume: $1.97B

This triggered a funding frenzy:

June 2025: $185M Series C → $2B valuation

October 2025: $300M Series D → $5B valuation (led by Sequoia + a16z)

December 2, 2025: $1B Series E → $11B valuation (led by Paradigm; Sequoia, a16z, Meritech, IVP, ARK, CapitalG, YC participated)

Paradigm’s Matt Huang said:

Kalshi’s exponential growth shows the massive latent demand for prediction markets—from institutions to everyday people. What brings people in is one type of market; what keeps them is the breadth. This is a cultural and economic phenomenon with no ceiling—similar to how we felt about crypto a decade ago.

The Real Engine Behind Kalshi’s Growth

After the November 2024 election, one big question loomed: Could Kalshi maintain its explosive momentum? Elections are infrequent, and the next presidential race wouldn’t arrive until 2028. Investors and analysts were watching closely to see whether user engagement would collapse after the election frenzy faded.

Kalshi, however, delivered a clear answer. The company executed a strategic pivot and discovered a new category of markets that quickly became its next major growth engine.