The Doctor’s ChatGPT Hit $6B Valuation in 3 Years

The Overlooked AI Hardware Revolution Hiding in Photo Frames

A startup that could reshape the U.S. healthcare system is quietly rising. Often described as “Medicine’s Google Moment” or “ChatGPT for doctors,” it has grown to a $6 billion valuation in just 3 years — and is already used by 40% of U.S. physicians.

A few days ago, OpenEvidence reported a new $200 million funding round led by Google Ventures, with Sequoia, KP, and others joining in — pushing its valuation to $6 billion. Just this July, it raised $210 million at a $3.5 billion valuation, following a Sequoia-led Series A last year.

Why OpenEvidence Took Off So Fast

To understand OpenEvidence’s rapid ascent, you first need to understand what modern doctors are up against.

CEO Daniel Nadler realized that physicians today are drowning in information: thousands of new papers are published daily, and medical knowledge doubles every five years. By the time a doctor finishes residency, half of what they learned in med school is already outdated.

The problem isn’t lack of knowledge — it’s finding the right evidence. Imagine trying to determine whether a psoriasis drug is safe for multiple sclerosis patients — and the answer is buried halfway through a 30-page clinical study. Google and traditional databases simply can’t handle this kind of deep retrieval. Doctors don’t need more data; they need usable evidence.

From Wall Street AI to the Clinic

Nadler wasn’t a medical insider. He holds a Ph.D. in political economy from Harvard and previously founded Kensho, an AI company that revolutionized financial analysis and was later sold to S&P Global for $700 million.

After that exit, he turned his attention to medicine — partly out of technical curiosity, partly due to personal loss:

If AI can help banks make better decisions, why can’t it help doctors avoid mistakes?

In 2021, Nadler and Harvard machine learning Ph.D. student Zachary Ziegler founded OpenEvidence, investing $10 million of their own money. They saw parallels between finance and healthcare: both are data-heavy, error-sensitive, and knowledge-intensive.

A Contrarian Approach to AI

While everyone else chased bigger and bigger models during the 2022 AI boom, OpenEvidence went the opposite way.

“General models are like JPEG compression of the internet — but the internet is full of travel blogs and diet tips,” Nadler said.

“We’re compressing medical knowledge.”

Their models are trained only on high-quality, authoritative medical data — from the FDA, CDC, and NEJM — designed to be hallucination-free. Every answer is backed by citations; if the literature is inconclusive, it simply says “no answer.”

This “zero-hallucination” philosophy has become its core moat — earning the trust of skeptical physicians.

A Consumer-Style Growth Model in Medicine

Instead of selling to hospitals or insurers — where procurement cycles take months or years — OpenEvidence went Direct to Clinician.

Doctors can sign up for free after verifying their NPI (National Provider Identifier). This frictionless entry fueled explosive adoption:

from 358,000 monthly consultations in 2024 to 16.5 million by 2025, with 430,000 registered doctors — nearly 40% of all U.S. physicians — and 100,000 daily active users.

From Search Engine to Second Brain

What started as a “verifiable medical search engine” has evolved into a full clinical assistant — essentially a second brain for doctors.

It can draft insurance authorization letters, patient education materials, risk scores, and continuing education modules.

DeepConsult analyzes hundreds of studies to give integrated recommendations for complex cases, while Visits transcribes encounters in real-time and suggests treatments.

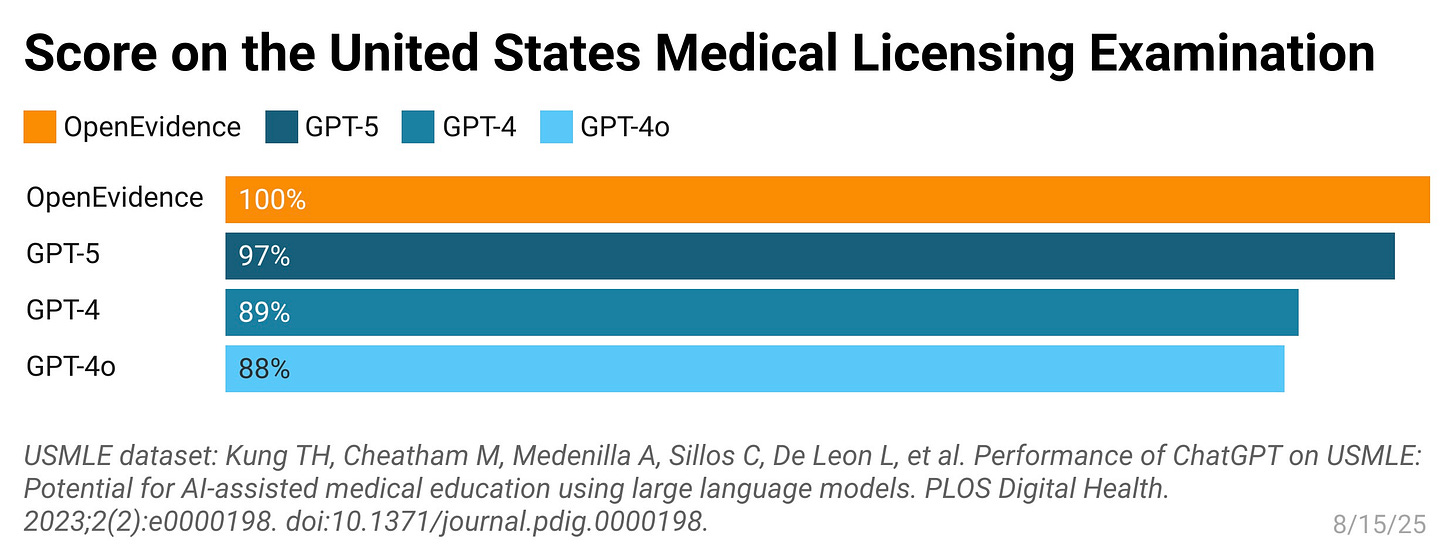

It also became the first AI system to score 100% on the U.S. Medical Licensing Exam, prompting leading medical journals like NEJM and JAMA not only to use it but to license their content to the platform — creating a flywheel:

More authoritative data → More doctors → More feedback → More publisher partnerships.

That loop continuously improves the model and democratizes access to medical evidence.

A Google-Like Business Model

Like Google, OpenEvidence is free for users and monetized through pharma ads. Drug companies spend ~$20B a year on marketing in the U.S., yet traditional channels are inefficient.

OpenEvidence inserts evidence-based ads at the point of decision-making, clearly labeled and separated from content.

It works — by July 2025, OpenEvidence had hit $50M ARR, projected to surpass $100M ARR by 2026. Its ad CPMs run $70–$150, nearly 10× higher than social media.

Kleiner Perkins founder John Doerr calls it “the Google of healthcare.” But Nadler’s vision goes beyond search — toward medical superintelligence.

As more doctors use OpenEvidence, their anonymized insights feed back into the system — training it on real-world reasoning, not just research. Nadler believes this could become “the most important knowledge infrastructure of the next decade.”