The 1st AI Note-Taker Surpass $100M ARR, 2 AI Fitness Apps hit $160M and $10M ARR

The Next $100M Health Companies Are Built Around Personalization

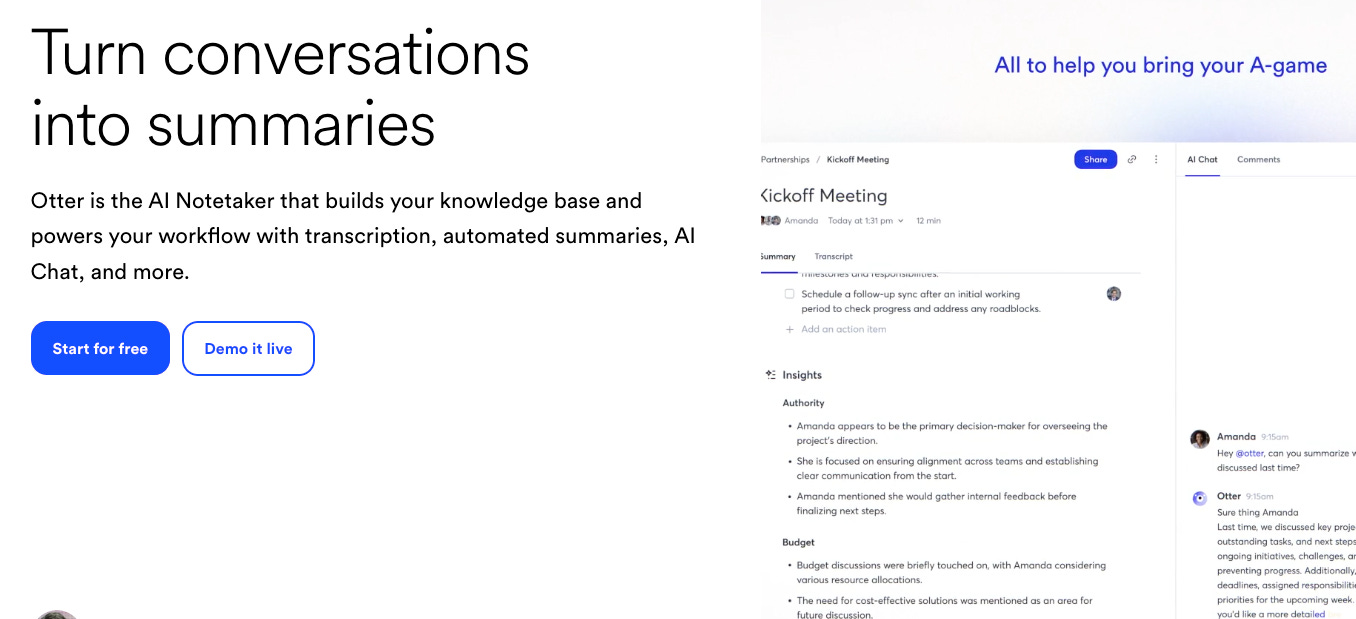

Otter: The First $100M ARR AI Note-Taker

Despite the crowded market of AI note-taking and meeting products, Otter appears to be the only one that has reached over $100 million in ARR so far.

In its 2025 annual summary, Otter revealed that it has fully evolved from a single-purpose AI meeting transcription tool into a comprehensive enterprise knowledge suite.

Otter now has more than 35 million users globally and has processed over 1 billion meetings in total. As recently as March this year, the user count stood at 25 million—meaning the company added another 10 million users in just nine months. Today, Otter operates with fewer than 200 employees.

Otter was founded relatively early, in 2016, by Sam Liang and Yun Fu. Sam Liang was a core architect behind Google Maps’ location services and previously founded Location Labs, which was later acquired for $220 million.

When Otter was first created, today’s generative AI did not yet exist, so the team had to build its own models from scratch. The original problem they set out to solve was simple: meetings are the biggest time sink for knowledge workers, and voice data is a vastly underutilized gold mine.

Before 2025, Otter’s core product remained a meeting transcription tool, growing through a freemium, bottom-up adoption model that attracted a massive user base. However, with the rise of generative AI, the team recognized that transcription and summaries alone were no longer sufficient to meet market expectations.

As a result, in 2025 Otter launched its AI Meeting Agent Suite, marking a shift from a passive tool to an intelligent agent. The product transformed Otter from a silent recorder into an active participant in meetings—capable of answering questions, assigning tasks, and assisting with sales presentations.

The suite consists of three core products:

First is the Otter Meeting Agent, which can answer questions based on all of a company’s meeting data, assign follow-ups, draft emails, and turn meeting records into an interactive knowledge base—bridging the gap from “recording” to “action.”

Second is the Otter Sales Agent, which provides real-time coaching and objection handling during sales calls. This places Otter squarely in the vertical AI agent market. Because sales scenarios directly impact revenue, the commercial value is significantly higher. Otter believes vertical AI agents represent a major opportunity and plans to launch additional agents for functions such as marketing, recruiting, and beyond.

The third is the Otter SDR Agent, which can autonomously run product demos and perform 24/7, hands-free lead generation. By fully automating the top of the sales funnel, it dramatically improves both sales and marketing efficiency.

Otter credits this transformation as the most critical factor behind crossing $100 million ARR. By upgrading its value proposition from “saving time” to “driving revenue and automating business workflows,” Otter can charge enterprise customers more and unlock exponential revenue growth.

The latest enterprise suite also includes APIs for external system integrations, an MCP server that connects Otter with external AI models, and customized meeting summaries. These summaries automatically extract actionable insights based on meeting objectives and roles—such as sales, recruiting, or project management—allowing users to seamlessly capture key data and knowledge from every conversation.

According to Sam Liang, Otter’s mission today is to help enterprises turn meetings into dynamic, searchable knowledge bases that enable smarter decisions and stronger collaboration.

It’s clear that Otter has largely completed its transition from a consumer-focused AI meeting transcription tool into an enterprise-grade product suite.

While meetings remain at the core, Otter has significantly expanded how information is captured—integrating not only unstructured voice data but also fragmented enterprise data from other platforms via APIs.

2 AI Fitness Apps hit $160M and $10M ARR: Why the Next $100M Health Companies Are Built Around Personalization

Over the past year, a clear pattern has started to emerge in consumer health: the most successful products are no longer selling workouts, calorie logs, or generic plans. They are selling personalized guidance at scale, powered by AI.

Two companies illustrate this shift particularly well, which are hitting $160M and $10 ARR separately.