The $100M Formula: Hardware + Subscriptions Are Eating the Consumer Market

ElevenLabs ARR Hit $200M, Cognition Hit $150M, Databricks Hit $4B

Hi, my friends, many big milestones this week. You can also check ~400 promising(still growing) startups’ ARR milestones and other key memos tracking at data.arr.club, a signal tracking database for promising AI startups I am building:

Databricks ARR Hits $4B

Databricks has surpassed $4 billion as of Q2 2025, marking an impressive year-over-year increase of over 50%.

This milestone is propelled by surging demand for its AI offerings, which alone contribute $1 billion ARR.

The company serves roughly 15,000 clients globally—including heavyweights like Shell and Rivian—and reports over 650 customers spending $1 million or more annually.

Meanwhile, the company also closed a $1 billion Series K funding round, valuing Databricks at over $100 billion. Investors include Andreessen Horowitz, Insight Partners, Thrive Capital, MGX, and WCM Investment Management.

Notably, Databricks continues to maintain positive free cash flow and targets over 140% net revenue retention, underlining its strong financial health and scalable growth model.

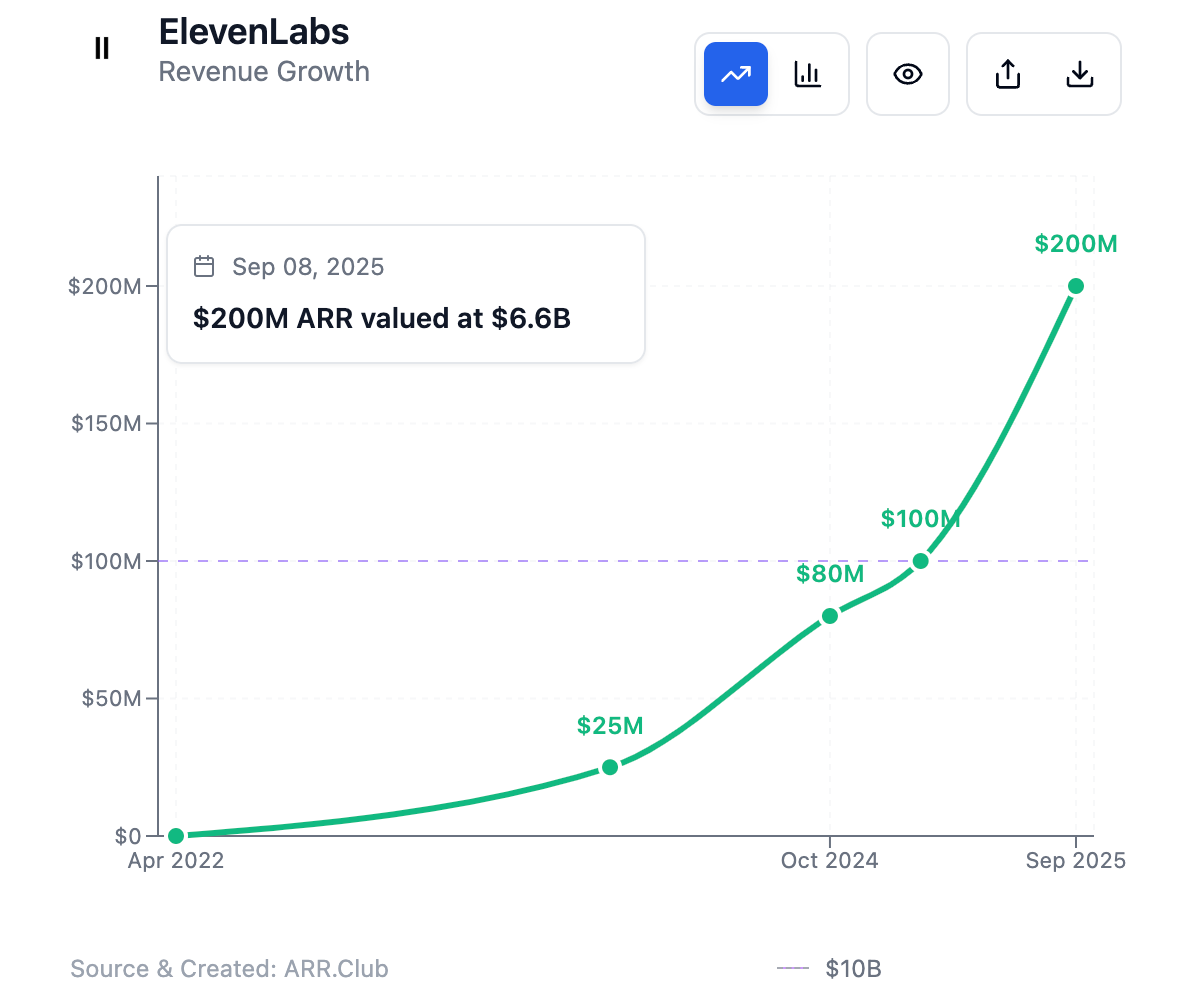

ElevenLabs ARR Hits $200M

ElevenLabs—a rising star in AI-driven voice synthesis—has officially surpassed $200 million in ARR.

The company expects to reach $300 million in ARR by year-end, underpinned by an impressive 200% YoY growth in enterprise revenue and a balanced mix between enterprise and self-serve revenue streams, now approaching a 50/50 split.

Additionally, its Agents Platform empowers businesses to build AI-driven conversational agents—2 million+ deployed so far—enabling use cases across customer support, scheduling, education, and more, with seamless integration and low latency.

In January 2025, it closed a $180M Series C round, boosting its valuation to $3.3 billion and bringing total funding to around $281M.

Notably, just nine months later, the company launched a $100M employee tender offer at a $6.6B valuation, doubling its prior Series C valuation.

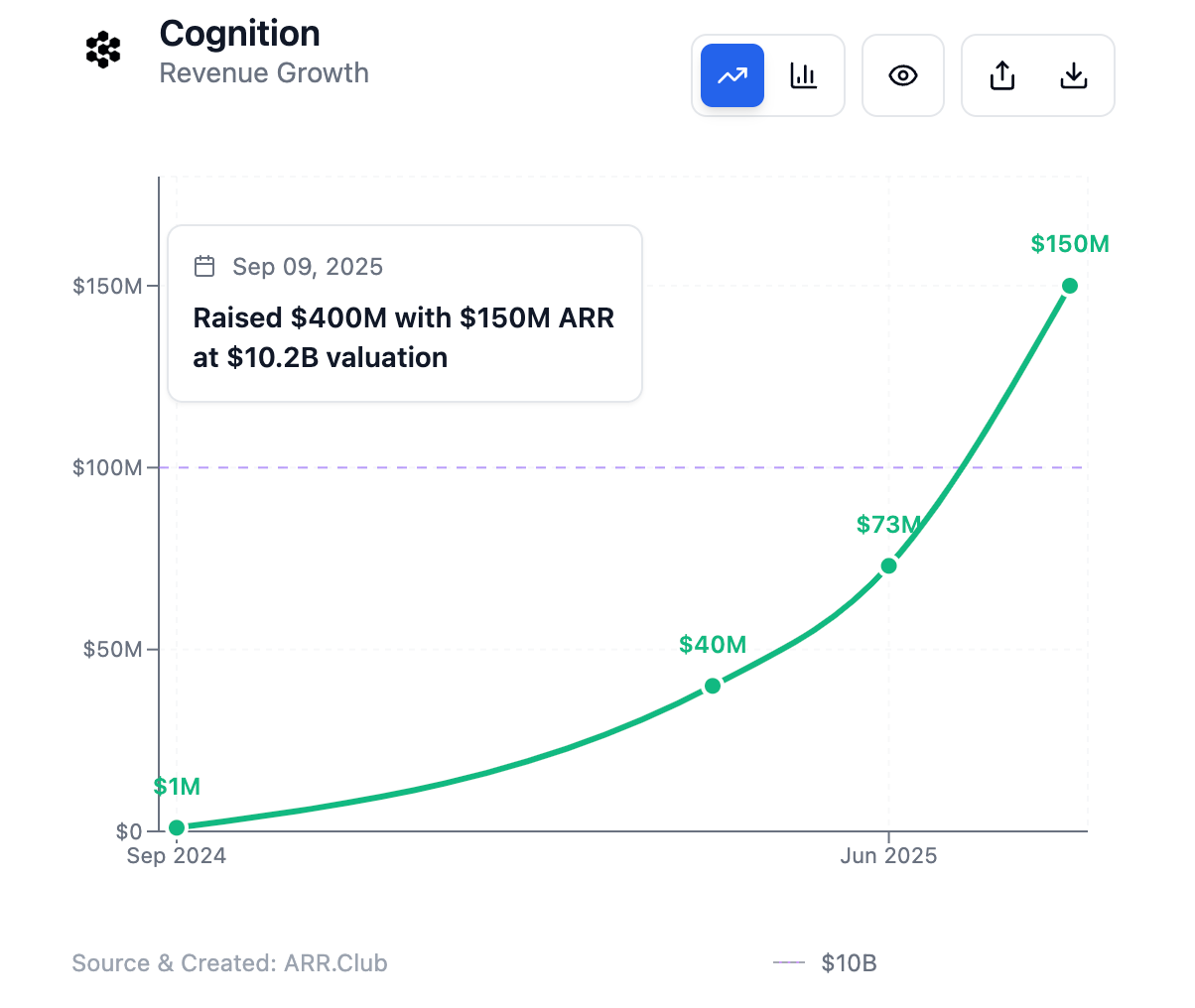

Cognition(Devin+Windsurf) ARR Hits $150M

Cognition, the AI coding company behind Devin and Windsurf, has rapidly scaled its annual recurring revenue to more than $150 million ARR in 2025, following the acquisition of Windsurf.

Devin, launched in March 2024 as the world’s first AI software engineer, grew from $1M ARR in September 2024 to $73M ARR by June 2025, reflecting exponential adoption as developers embraced autonomous agents for real-world engineering tasks.

The addition of Windsurf more than doubled ARR, with combined enterprise revenue up 30% in just seven weeks post-acquisition, underscoring Cognition’s momentum in the AI coding space.

Financially, Cognition has raised over $400 million in funding at a $10.2 billion post-money valuation, led by Founders Fund with participation from Lux, 8VC, Neo, Elad Gil, and others.

With less than $20M net burn across its history, the company has achieved remarkable capital efficiency while scaling rapidly.

The Rise of Hardware + Subscription: 5 $100M+ Revenue money machines

A quiet revolution is happening at the intersection of hardware and software. For years, hardware companies struggled with razor-thin margins, while software companies thrived on recurring revenue.

But a new wave of startups is blurring that line—by combining physical devices with subscription services, they’ve built businesses that look and behave more like SaaS than traditional consumer electronics.

The playbook is simple: start with a compelling piece of hardware that solves a clear, everyday problem. Then, layer on subscription services that keep adding value over time. The result? Stickier products, recurring revenue, and margins that rival pure software companies.

Over the past year, I’ve been tracking this trend closely. From sleep rings and pet trackers to smart bird feeders and screen-free kids’ players, the “hardware + subscription” model is quietly producing nine-figure revenue businesses across multiple verticals. One of the clearest examples is Oura, but it’s far from the only one.

Let’s start with the company that put this model in the spotlight: Oura. Months ago, the smart ring company raised $200M at a $5.2B valuation. With over 2.5 million rings sold, Oura doubled both its membership base and revenue in the past year, hitting $500M in revenue.