Selling a plugin for $4B, he built an “AI-era DoubleClick” and raised nearly $60M

EliseAI ARR Hits $100 M

Some big milestones tracked last week: OpenAI, Databricks and EliseAI.

EliseAI ARR Hits $100 M

EliseAI is an enterprise AI platform automating complex operations in healthcare and housing. Building on its housing-first foundation and rapid expansion into healthcare, the company is now scaling aggressively across both verticals.

Its platform streamlines deep operational workflows by embedding AI agents into industry-specific processes.

In healthcare, solutions integrate with EHR systems to manage patient scheduling, intake workflows, and compliance-heavy tasks—cutting administrative overhead significantly.

In housing, EliseAI powers everything from AI-guided leasing and resident communications to delinquency recovery and maintenance triage—automating over 90% of interactions, boosting engagement, reducing delinquencies, and accelerating lease conversions.

EliseAI recently secured a $250 million Series E, led by a16z with participation from Bessemer, Sapphire Ventures, and Navitas Capital, pushing its valuation to over $2.2 billion—more than double just a year ago.

Databricks ARR Hits $3.7B

With $3.7 billion ARR, Databricks is marking robust 50% year-over-year growth fueled by surging demand for AI-enabled solutions.

The company’s flagship “lakehouse” platform enables organizations to seamlessly integrate and manage both structured and unstructured data, empowering AI-driven analytics and workflows.

This platform supports AI-driven use cases such as custom AI agents (“Agent Bricks”) and high-performance querying (“Lakebase”), enabling enterprises to transform proprietary data into intelligent insights and applications.

Databricks also secured a $100 billion+ valuation via an oversubscribed Series K funding round.

OpenAI Hits $1B in Monthly Revenue

CFO Sarah Friar said that OpenAI hit its first $1 billion revenue month in July.

Even as the company hits revenue milestones, it faces ongoing pressures due to the demand for computing power required for artificial intelligence.

This explosive growth is largely fueled by skyrocketing demand for its AI offerings, with ChatGPT now boasting around 700 million weekly active users, including millions of paying business customers.

However, this meteoric rise comes with equally formidable costs: projected cash burn for 2025 has increased to around $8 billion due to physical infrastructure buildout and compute demands. OpenAI is also exploring new revenue lines, such as leasing out AI-ready data centers and compute infrastructure, to help offset these soaring expenses.

DoubleClick of the AI Era just raised nearly $60M

In 2008, Google acquired DoubleClick for $3.1B in cash, cementing its dominance in search advertising during the internet and mobile internet era, and making Google Search its most powerful money-making machine.

But with the arrival of the AI era—especially the rise of answer engines. Google’s most profitable business model is now under threat.

Several recent GEO (AI SEO) products have already demonstrated the potential of a new AI-era ad model.

Traditional SEO players are using GEO tools to add $1M in ARR every two weeks, while VCs are beginning to bet heavily on GEO startups.

After all, ChatGPT now has 700M WAUs and processes more than 1B queries daily—about one-eighth of Google. If growth continues at this pace, by 2029 AI assistants could drive 30% of all product decisions.

In a recent talk between Lenny and Reforge founder Brian Balfour, Brian argued that ChatGPT will be the next major growth channel.

He noted that it has already reached the second stage of the four-stage platform cycle (innovation, distribution, platformization, and competitive intensity)—specifically the phase where third-party ecosystems open up.

Analyzing historical platform data, Brian observed that early entrants usually reap the biggest rewards—for instance, Zynga leveraged early Facebook data insights to scale into a multi-billion-dollar business.

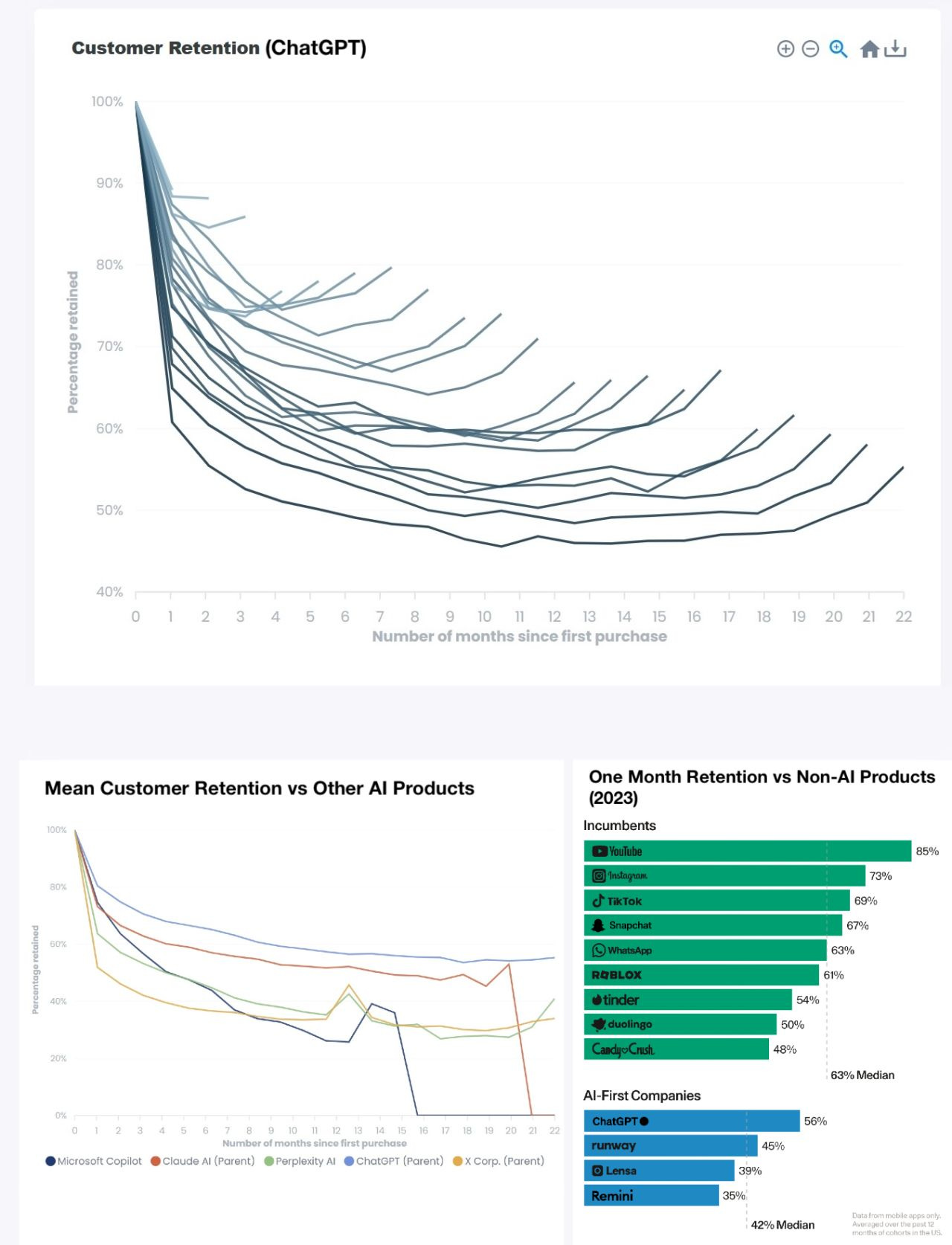

He predicted that ChatGPT could open to third-party platforms within six months, as signals such as developer activity, API usage, and retention curves already suggest readiness.

Brian also emphasized that a platform’s distribution power sets the ceiling for product growth, and that changes in distribution channels often reshape entire industries. He believes AI Agents will become the mainstream distribution channel of the future.

Below is ChatGPT’s retention curve: its one-month retention rate has surged from under 60% two years ago to an unprecedented ~90%. YouTube once led the industry with ~85%. Its six-month retention is trending toward ~80%, with the curve accelerating sharply upward.

That’s why I believe the “DoubleClick of the AI era” should be emerging right about now.

And indeed, while I did some research about GEO (AI SEO), I came across a brand-new product explicitly aiming to become the AI-era DoubleClick—having just raised nearly $60M.

It has strong potential because the founder has a long history with ad-related products. A few years ago, he co-created an ad plugin with his partner that amassed 30M of users—and sold for $4B.

Afterward, he launched another plugin helping creators and advertisers monetize through ads, attracting 10,000+ ad partners and millions of users.

Now, building on these networks, he has created an AI-era DoubleClick: a platform allowing developers to build free AI products monetized via ads instead of paywalls.

It natively integrates ads into the reasoning process of AI responses, embedding sponsored content directly in real-time answer generation.