Meta’s Bet on Manus Matters for Chinese Founders, An AI Speaking App Grew 100x ARR in a Year

A small pivot drove a 540× yoy MRR growth

Meta’s Multibillion-Dollar Bet on Manus Signals a New Era for Global (Chinese) Founders

Meta’s acquisition of Manus, reportedly valued in the multibillion-dollar range, is more than just a massive financial win for its founders and investors. It marks a meaningful inflection point—not only for the global AI market, but also for a new generation of AI founders from China building products for the world.

While Meta has not disclosed the exact acquisition price, speculation on X suggests that Benchmark may have effectively returned most—if not all—of its recently raised $425 million AI-focused fund from this single investment alone.

That said, Benchmark’s exposure to Manus likely spans multiple vehicles, including a later partner-only fund, meaning returns are probably split across at least two funds. Even so, the implication is clear: this was not a small exit.

And Benchmark Partner Eric Vishria made it clear that the deal made the fund a 1000% IRR.

Public reporting consistently points to a multibillion-dollar deal, widely described as Meta’s third-largest acquisition ever, trailing only WhatsApp and Scale AI. For ZhenFund, an early investor based in China, this also represents a landmark win. For a product that has been officially live for less than a year, the outcome is nothing short of extraordinary.

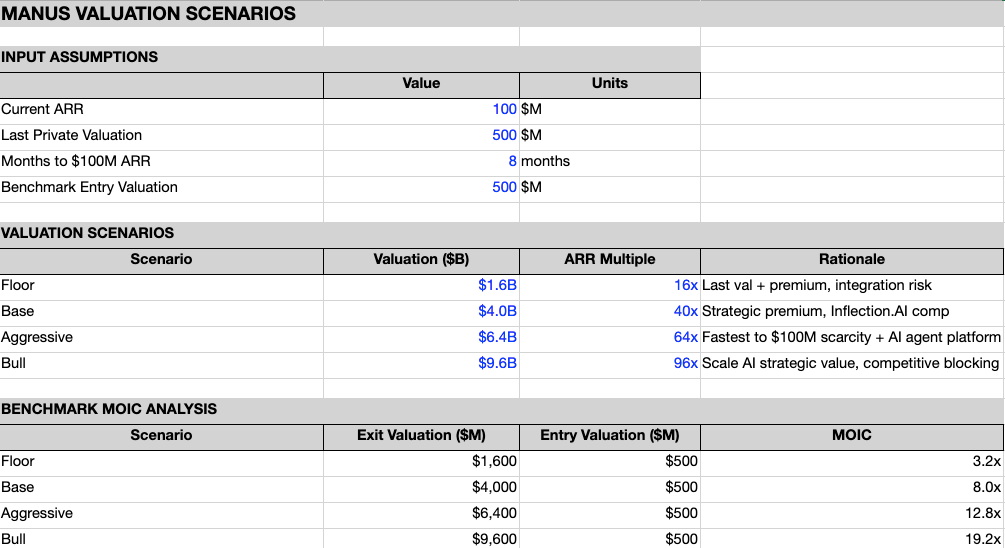

Ramp Labs published one of the most thoughtful valuation models I’ve seen so far. Using comparable AI M&A transactions and the fact that Manus became the fastest AI product in history to reach $100 million ARR—doing so in just eight months—their analysis suggests a likely acquisition range of $4–6 billion, after excluding extreme low ($1.6B) and high ($9.6B) outliers.

This estimate feels directionally sound. Reports also indicate that Manus had been fundraising at a $2 billion valuation shortly before the acquisition, making it unlikely the final price came in below that level. Ramp’s full model is available here.

There were also rumors that Microsoft had explored an acquisition, and that ByteDance had previously attempted to acquire the team’s earlier product, Monica—but walked away after being quoted a price they considered too high.

In the end, Meta reportedly moved decisively, completing the acquisition process in just over ten days.

I first paid attention to the Manus team in July 2023, when they were still operating under Monica, alongside other early AI products built by Chinese teams for global markets. At the time, none of us could have predicted how far these companies would go.

Now, Meta acquires Manus for multi-billions, Monica is still on a16z’s Top 50 AI Mobile Apps. And Opus Clip hit $20M ARR in 18 months.

In hindsight, a clear signal emerged last year when Benchmark led consecutive investments in HeyGen and Manus, both founded by Chinese teams. It marked a shift in how top-tier U.S. VCs were reassessing long-held assumptions.

Despite ongoing geopolitical tensions, Benchmark moved from broadly avoiding China exposure to selectively backing world-class Chinese-founded teams—those with strong technology, relentless execution, and a clear ability to scale globally.

That decision was controversial. Benchmark’s investment in Manus drew sustained criticism from Founders Fund partners and other prominent investors, and there were even reports of scrutiny and pressure to unwind the deal.

Taken together, Benchmark’s bets and Manus’s acquisition suggest that for truly exceptional products, geopolitical barriers may be more navigable than once feared.

For Chinese AI founders, the message is clear: building globally competitive products can unlock not just users, but access to global capital at far more rational valuation multiples.

An AI Speaking App Grew 100x ARR in a Year: A small pivot drove a 540× yoy MRR growth

At the same time, I’ve been closely tracking a very different kind of story—one that offers an equally powerful lesson in AI growth mechanics.

Over the past year, an AI-powered spoken English learning product increased its ARR by more than 100×.

Even more striking, its MRR over the past month alone is more than 500× higher than the same period last year. The catalyst wasn’t a complete product overhaul, but the decision to spin out a single internal feature into a standalone acquisition engine.