How popular podcasts make a 7-figure just from a sponsorship

How Acquired and other top podcast make money

Hey everyone, welcome 10+ new friends onboarding. The Signal is a hand-curated newsletter where content is generated both by humans and AI. It covers the tech and venture capital industry, which includes:

A curated newsletter on the growth momentum of startups, twice or 3 times a week.

A deep-dive story about a business or a tech trend, once a week.

Every business is/has/needs a story, share your story or make it a story. Here is today’s story:

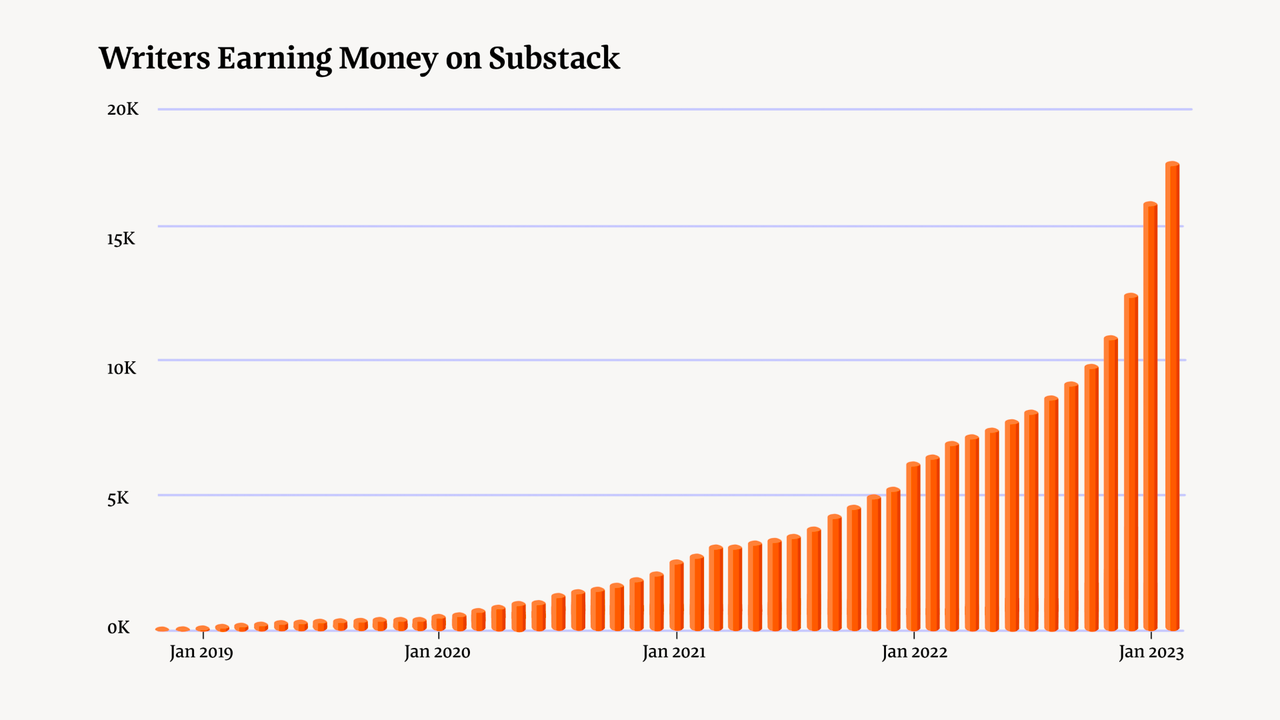

The rise of the creator economy has enabled numerous individuals to make a profit. In addition, it has fostered the development of various tools and platform products, such as Substack, Beehiiv, and Ghost.

While these platforms primarily focus on text-based content, Substack has expanded its support to include podcasts and videos.

Substack, a platform for newsletters, boasts over 2 million paying users, supporting a community of more than 17,000 creators who earn money. The top ten creators on Substack earn an impressive annual income of over $25 million.

However, the most lucrative creator platform is Onlyfans, which primarily focuses on adult content. With a revenue of $1.10 billion last year, Onlyfans surpassed the $525 million mark profit.

Beside newsletter, podcasts have gained immense popularity in the West, especially in the US. It is now a big thing, some podcasts generate millions of dollars in income solely through advertising sponsorships.

The Growth of Acquired

I recently took some time to study two podcasts that I enjoy and admire. One of them is Acquired, a well-known podcast in the tech world, co-hosted by Ben Gilbert and David Rosenthal.

Apart from the podcast's popularity and its in-depth content, what impressed me the most was Ben’s sharing about Acquired's growth journey:

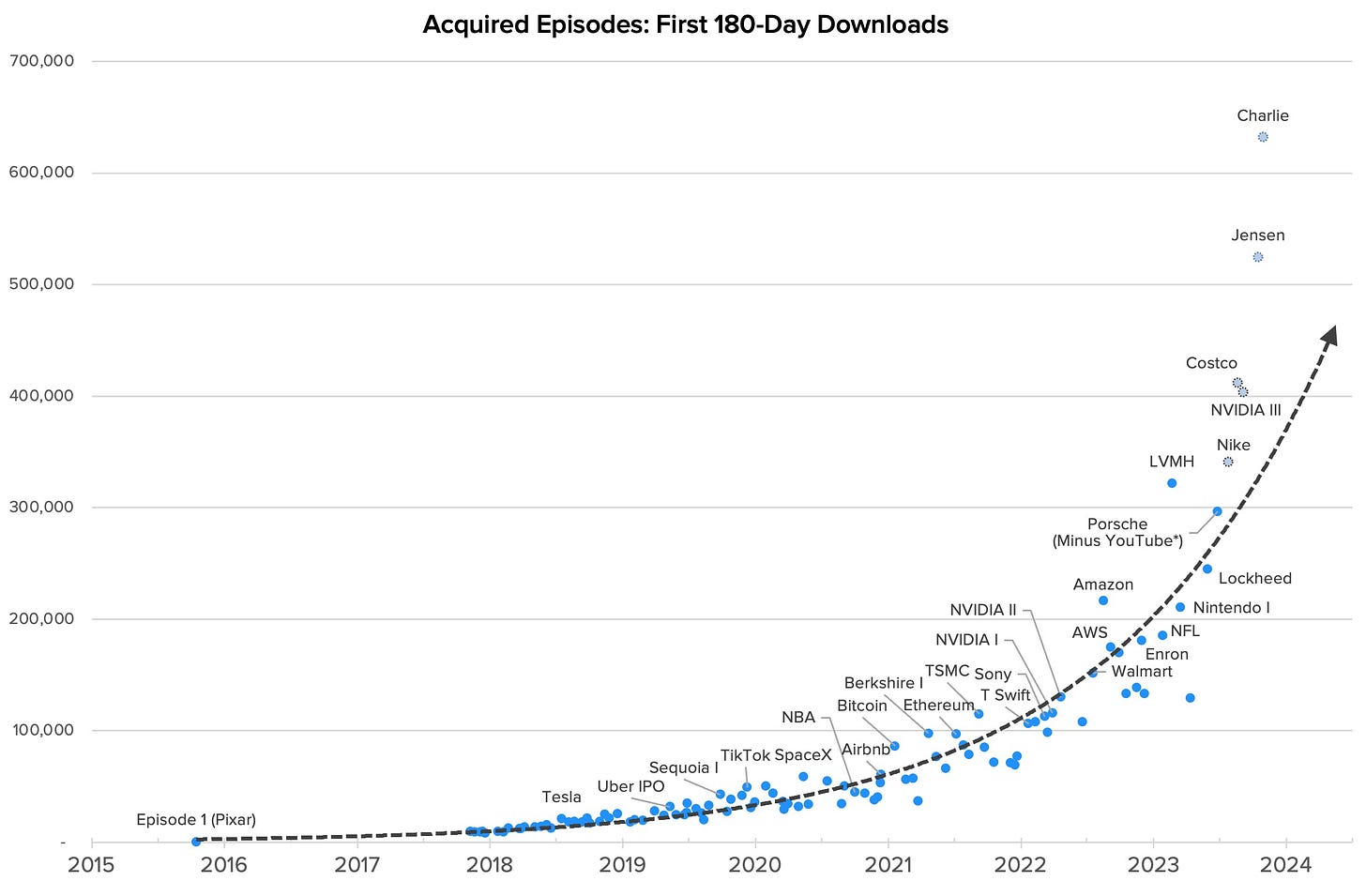

Acquired's growth trajectory is similar to that of many SaaS products. In the early days, the growth was relatively slow. However, over time, they gradually show an exponential growth trend, becoming faster and faster.

It has been running for 8 years, which can be considered a win to Ben and David’s dedication and long-term commitment. It's like playing a snowball game, where momentum gradually accumulates over time.

According to co-host Ben Gilbert, among other things, this only would have worked if they:

1. Picked topics we were extremely interested in and would learn about for free;

2. Enjoyed the intrinsic reward of honing our craft;

3. Enjoyed the extrinsic reward of people telling us that we made a product that was good/valuable for them.

In his statement, he highlighted the importance of interest, internal motivation, and external recognition and rewards, which I believe are essential for any long-term career success.

The first two are intrinsic to the product itself, while the third is external motivation. In my view, external motivation includes both spiritual reward and commercial support. When these three factors are present, they create a flywheel that sustains long-term commitment to the matter at hand.

The podcasts produced by Acquired are filled with very comprehensive content and each issue spans around 3-4 hours in length. The creation of each episode requires a tremendous amount of time, effort, and research. Unless you have a genuine interest in the topic, it can be quite challenging to remain engaged throughout the podcast.

Ben and David once shared that they had created a podcast about Nike. In preparation for it, they read over 10 books, more than 40 articles, podcasts, and YouTube videos about Nike. In the end, they shared a list of 117 links, plus a 42-page Pitchbook report on Nike.

As a newsletter writer, I understand the cost of producing one issue of content. Each value fragment can be seen as the outcome of a gradual and continuous accumulation over time.

This in-depth research process is quite time-consuming, leading to a slow production of Acquired podcast content. On average, it takes about a month to produce 1-2 issues of content.

While not every issue requires as much time as Nike, each episode still requires a minimum of 100 hours of work. As of now, the podcast has released a total of 18 issues this year.

In its early days, Acquired experienced sluggish growth, Ben Gilbert acknowledges today that if Acquired had been a startup, it would have been shuttered after two years due to its slow growth.

For years, Acquired did not accept advertising. However, they eventually recognized that their target audience overlapped with the podcast listeners. It led them to accept the advertising sponsorship which pushed them to make the Acquired podcast better.

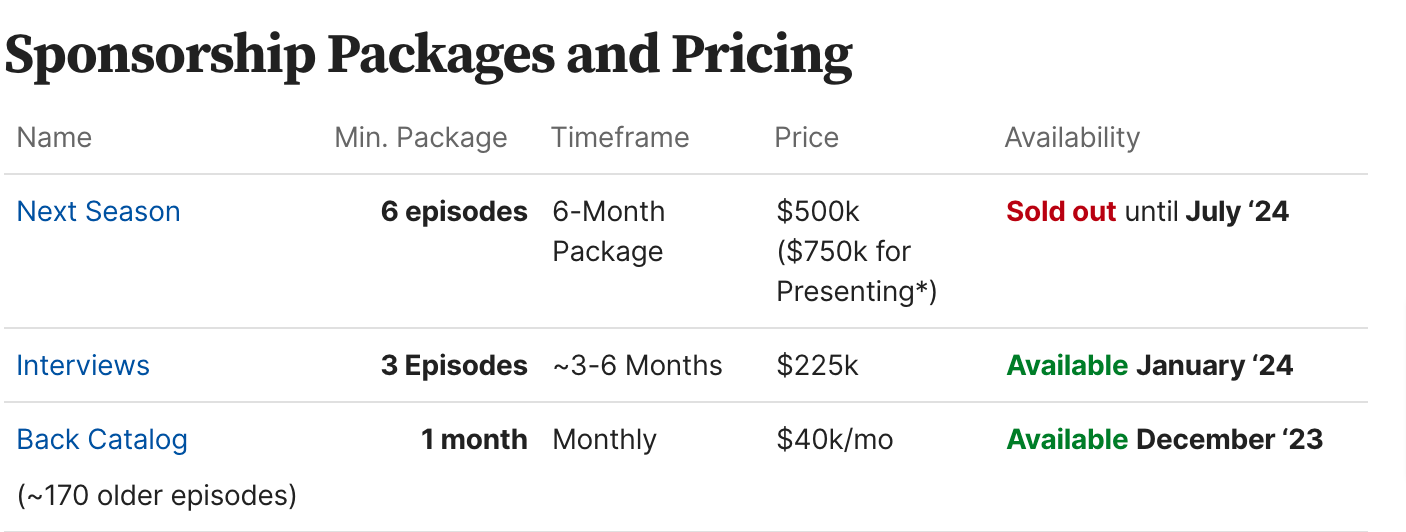

What interested me is the business model of podcast like Acquired. All of Acquired’s advertising sponsorships are pre-sold, while the highest package has been sold out until July 2024.

Now, it's not only driven by interest but also by business.

How Acquired Make Money

Acquired made millions from their 3 unique monetization model. Let's first take a look at Acquired's overview before discussing it.

According to Acquired, the show has over 450,000 active listeners every month. Additionally, each podcast episode has been downloaded by over 350,000 unique listeners within the first six months, and this number is increasing by more than 100% every year.

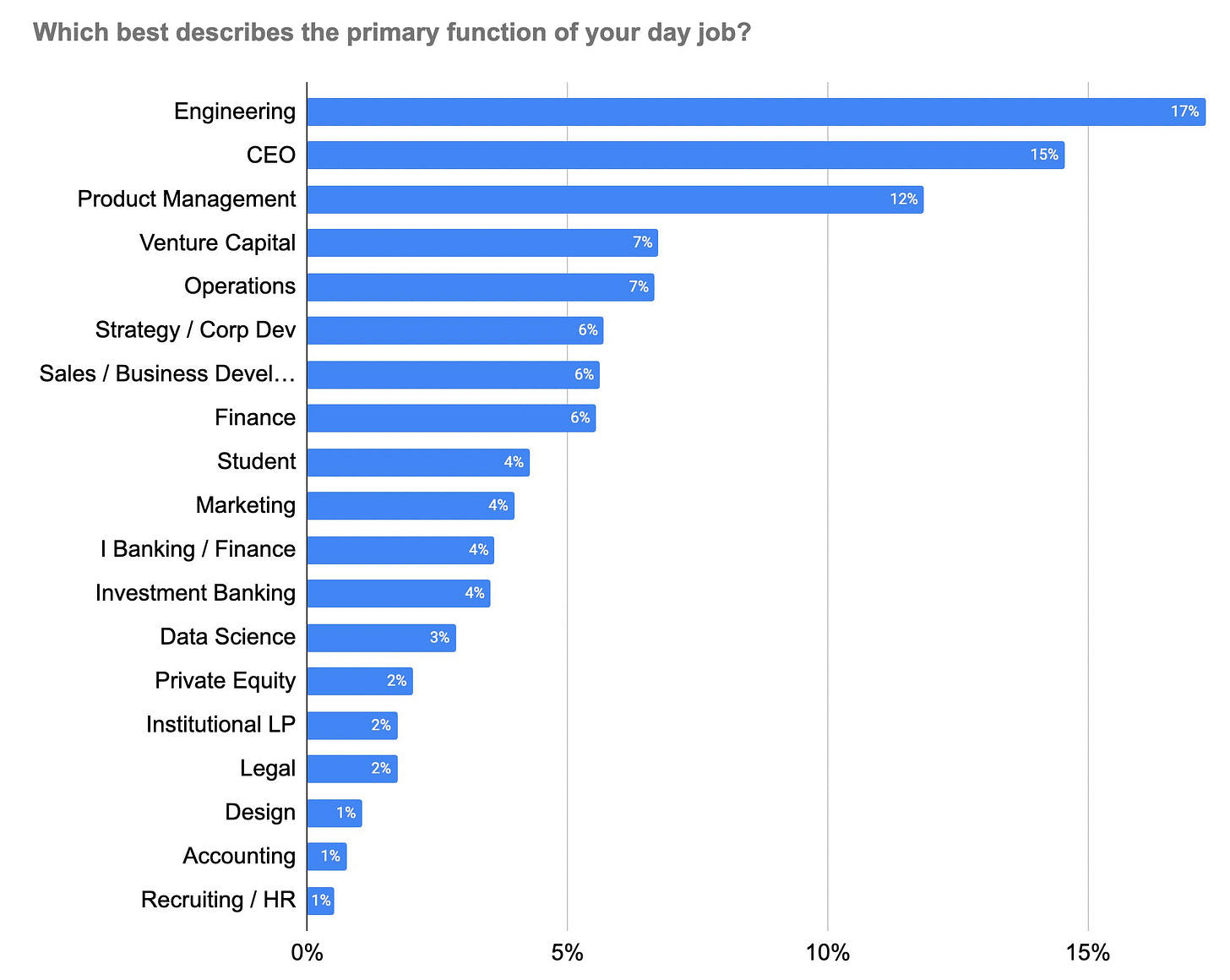

It has been ranked the #1 Technology show on Apple Podcasts and Spotify. Its audience is roughly composed of:

In several categories, the general breakdown is as follows:

Founders: 23% are currently company founders, while 12% have previously been founders. Additionally, 44% aspire to become founders in the future.

Executives: 40% of Acquired's audience are C-level or VP-level executives, and 71% work in the technology industry. For example, the entire Nvidia executive team (including CEO Jen-Hsun Huang) is an avid fan and listener.

Technical operations personnel: More than 50% work in start-up companies, and 30% are technical personnel (engineers, product managers, or data scientists).

Capital ecosystem: More than 30% work in venture capital, limited partner (LP), or other investment, finance, or corporate development roles.

In terms of geography and age, 69% were primarily from English-speaking countries (US, United Kingdom, Canada, Australia/New Zealand), 10% from the rest of Europe, 11% from Asia, and 10% from the rest of the world; 79% of listeners were between the ages of 23 and 40.

First one: Advertising sponsorship packages

Acquired's unique content results in a distinctive business model. There are three types of money-making mechanisms. The first one is advertising sponsorship, which can be categorized into three types of sponsorship.

The current queue for the highest prices of $500,000 and $750,000 extends until July 2024.

The price of the second-highest item is $225,000, and it is set to be scheduled for January 2024.

The third is similar to SaaS with a monthly payment of $40,000. This is the first time I learned about this mechanism in podcast, and I find it intriguing.

Even though Acquired has already scheduled its highest sponsorship program until July 2024, they claim that this schedule only includes about 5% of all potential sponsors. They have strict criteria for selecting advertising sponsors and aim to create valuable and relevant advertising content that aligns with the program's content.

3 types of Sponsorship Program

There are three types of sponsorship: Next Season, Interviews, and Back Catalog.

1. The first option is called "Next Season" and is priced at $500,000 or $750,000. The package covers about 6 episodes. This format typically involves a personalized segment by the host or an interview with the CEO/founder of the sponsor.

It is created in collaboration with Ben and David and lasts for 1-2 minutes. The segment is seamlessly integrated into the podcast content as an "interstitial".

Unlike other podcasts, each sponsor segment on every episode of their podcast is unique. Unlike many podcasts that record the same content once and repeatedly use it, they believe in creating fresh and engaging advertising content for their sponsors.

This means that if there are six episodes, they design at least six different versions of advertising content. Once these ads are created, they will be mentioned across all channels of Acquired such as Slack, email list, and the podcast show notes.

Each Season, there is an option for one “Presenting” Sponsorship which includes:

Placement of the Presenting Sponsor’s logo on the show’s album art and website

The Presenting Sponsor’s segment running within the first ~5 minutes of each episode before the main content begins

The Presenting sponsorship option is priced at an additional 50% above the base mid-roll sponsorship.

2. The second type of advertising sponsorship is: Interview, priced at $225,000. This sponsorship cycle lasts for 3-6 months, during which the advertising content will be featured in 3 podcast episodes.

It is somewhat similar to Next Season. The content of the advertisement is also 1-2 minutes, and the content is different each time. The only difference is that they are recorded after the interview and inserted in post-production.

Each package includes 3 episodes with world-class guests such as Nvidia CEO Jensen Huang, Berkshire Hathaway’s Charlie Munger, and Spotify CEO. These ads, just like the Next Season, will be mentioned on all channels of Acquired.

The picture shows an interview between Acquired and Charlie Munger in the latest October episodes, which was also the last comprehensive interview before Charlie Munger passed away.

3. The third type of sponsorship is called "Back Catalog". This sponsorship option charges $40,000 per month. It operates on a model similar to a SaaS monthly subscription, which I find quite intriguing.

With this package, advertisers have the opportunity to insert a 1-2 minute advertisement recording into the entire podcast catalog, specifically targeting the previous podcast content. The advertisements are currently in a queue, waiting to be included in the podcast episodes.

It is very unique due to the evergreen in-depth content, thier back catalog episodes continue to receive significant listens over many years as thier audience base grows(100% every year).

Second one: Speaking

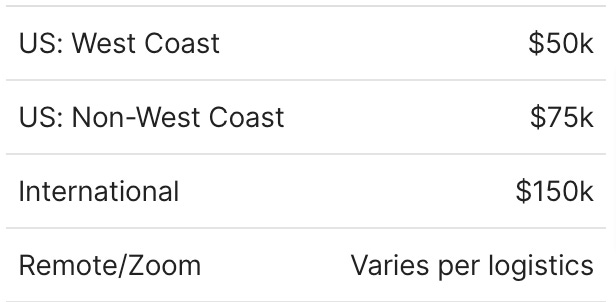

Every year Ben and David will pick some events to attend and speak. So this one is similar to an appearance fee.

These events primarily include customer conferences, investment company annual meetings, internal events, company all-hands, as well as dinners and other social gatherings.

Their participation takes various forms, such as delivering speeches, engaging in Q&A sessions, interacting with teams or groups, or a combination of these formats.

The charge plan is distinguished by region,as shown in the figure below.

Third one: Investment

In essence, it is not a cash flow business, but a long-term value and the potential for huge gains.

Some corporate clients recognize the advantages of collaborating with Acquired and are open to exploring investment opportunities. A recent illustration of this is the active involvement of Ben and David in Vanta's Series B financing round, resulting in Vanta being valued at $1.60 billion.

However, it is not yet a common practice for them, I think. Vanta is an exceptional case, as they have been a long-term sponsor of Acquired. Initially, when their CEO approached them, they were rejected due to Vanta's association with a company invested in by Ben's investment institution, Pioneer Square Labs, which created a conflict of interest.

However, after the company went bankrupt, Vanta began collaborating with Acquired, and this collaboration eventually developed into a partnership with an investment.

In addition to the aforementioned three business models, Acquired has also started to explore alternative methods such as creating YouTube videos (with a current fan base of 52,000), organizing offline activities for branding purposes, and offering paid memberships. However, it is important to note that these initiatives are still in the early stages of development.

As the sponsorship packages have all been sold out,it is estimate that Acquired can make at least $3 million revenue from their sponsorship(750k*2+50k*2+4*12). They have already produced 18 episodes till now this year.

The business is projected to experience continued income growth, driven by its expanding audience and various other revenue streams.