Harvey ARR hit $100M, Big VC Winners Behind Figma IPO

Leverage AI to Build an $8M ARR Finance Platform

When OpenAI and Anthropic are competing on both fundraising and ARR growth, other AI startups are also growing rapidly.

Harvey ARR Hit $100M

Harvey AI, the generative AI assistant crafted by Counsel AI Corporation, has reached $100 million in annual recurring revenue (ARR) as of August 4, 2025—marking a significant milestone in its rapid ascent within the legal tech sector.

Originally founded in 2022, Harvey’s ARR surged from approximately $50 million in early 2025 to $75 million by April, and ultimately crossed the $100 million threshold, driven by robust demand from major enterprise law firms and corporate legal departments—including serving 42% of the AmLaw 100 firms—with over 500 customers across 54 countries.

Financially, Harvey has raised over $600 million across multiple funding rounds, including a $300 million Series D in February 2025 (valuing the firm at $3 billion) and a second $300 million Series E in June 2025, which propelled its valuation to $5 billion, implying a ~67× revenue multiple based on forward ARR projections.

With ~400% year-over-year revenue growth, an expanding client base exceeding 500 globally, over 350 employees, and ambitious plans to scale into adjacent professional services, Harvey is positioning itself as the dominant AI copilot in the legal industry and beyond.

Anaconda ARR Hit $150 M

Anaconda is the leading provider of open-source Python and R tools for data science and enterprise AI with operating profitably.

Founded in 2012, the company now supports over 50 million users globally—including 95% of Fortune 500 firms—powered by the launch of its Anaconda AI Platform earlier in 2025.

Anaconda’s flagship offering, the Anaconda AI Platform, addresses friction in enterprise AI deployment by unifying open-source distribution, secure dependency management, governance tooling, and analytics.

It simplifies Python and R package management, enforces role-based controls, and delivers actionable insights to streamline development pipelines—especially critical in regulated industries and large-scale AI production environments.

In July 2025, Anaconda closed a Series C funding round of over $150 million, led by Insight Partners and backed by Mubadala Capital, valuing the company at around $1.5 billion.

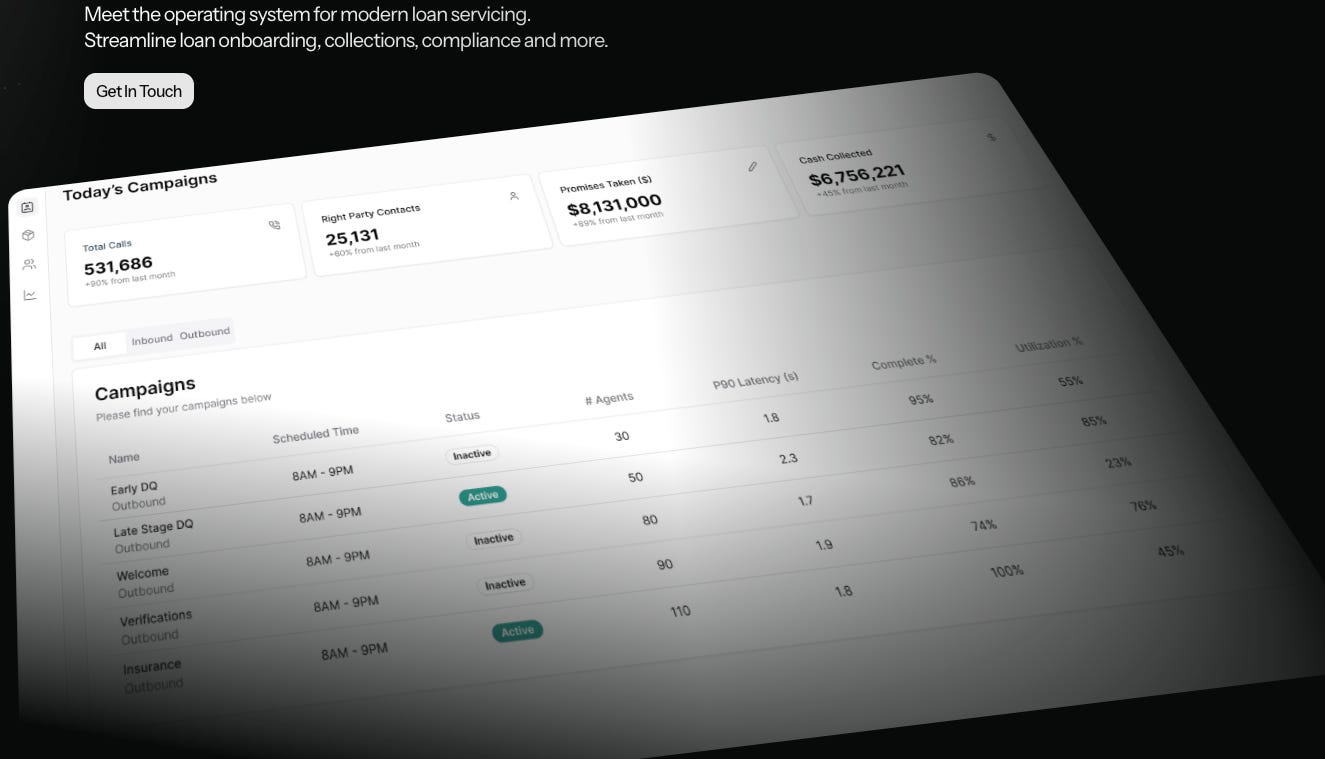

Salient ARR Hit $14M+

Salient is an AI startup founded in 2023 by Ari Malik and Mukund Tibrewala. It has rapidly scaled to an annual recurring revenue (ARR) of over $14 million and achieved cash‑flow positivity just 18 months after graduating from Y Combinator.

The company’s AI-driven loan servicing platform has already processed over $1 billion in transactions, with the team of under 20 employees handling around 400,000 borrower interactions per day.

Salient’s flagship product automates downstream consumer lending workflows using conversational AI agents across voice, text, email, and chat, along with compliance monitoring and fraud detection tools.

The platform addresses costly, manual processes in loan servicing—automating routine borrower interactions, regulatory checks, and dispute management—resulting in a 60% reduction in handling time and measurable cost savings for lenders like Westlake Financial, American Credit Acceptance, and other major auto‑lenders.

On the funding and company metrics front, Salient closed a $60 million Series A round led by Andreessen Horowitz in July 2025, raising its valuation to approximately $350 million, with participation from Matrix, Y Combinator, and Michael Ovitz.

The startup claims to have processed over $1 billion in loan payments, identified more than 35,000 compliance violations, flagged $30 million in fraud attempts, and touched over 2 million U.S. consumers through its platform—all powered by OSS LLMs like LLaMA 2 and vLLM.

Big VC Winners Behind Figma IPO

Figma’s successful IPO has unleashed a wave of new VC legend stories — particularly for those who backed the company early. Many of them didn’t just win — they won big.

Rough calculations based on current share prices show:

Index Ventures turned a $3.9M investment into $7.2B — a 1,850x return, or 17.5x the size of their $400M fund.

Greylock saw a 480x return, turning $14M into $6.7B, equating to 10.8x their $620M fund.

Kleiner Perkins netted $6B on a $25M check — a 240x return or 8x their $700M fund.

Sequoia had a 95x return, converting $40M into $3.8B, or 1.4x their $2.5B fund.

In other words, these firms earned multi-fund returns from a single investment.

Later-stage investors also did well: a16z reportedly made $1.5B on a $50M investment (30x), while Durable Capital turned $200M into $1.4B (7x).

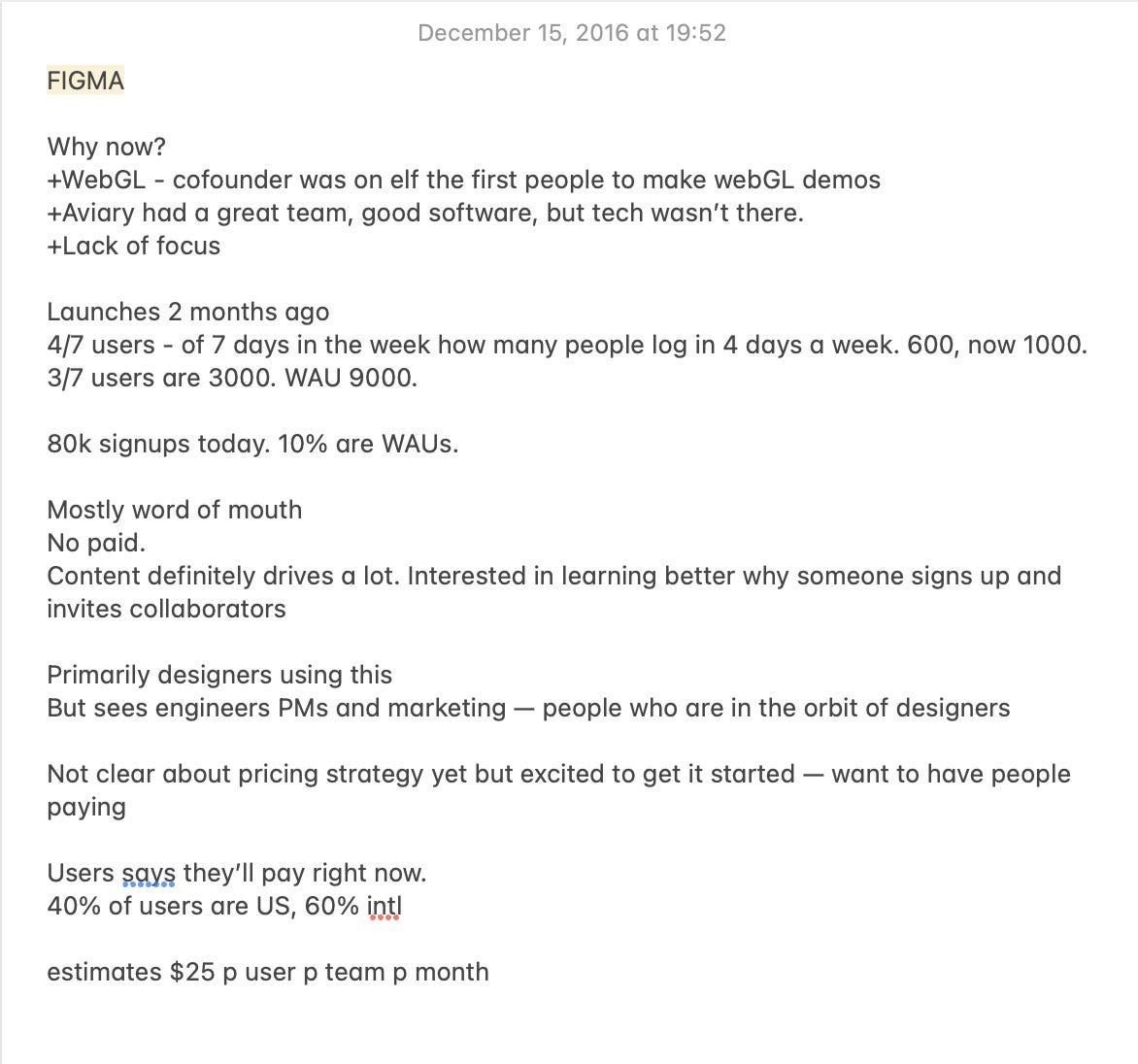

Of course, some firms passed. One notable miss was Initialized Capital, co-founded by YC President Garry Tan. According to co-founder Alexis Ohanian, the firm turned down the deal in 2016 — a decision documented in a now-public internal memo, though the reasons for passing weren’t shared.

That memo offered an early glimpse into Figma’s traction at the time:

The product had just launched two months earlier.

80,000 users had signed up.

Weekly actives were ~10%.

Daily active users logging in 4+ times/week grew from 600 to 1,000.

3-day-a-week users totaled ~3,000.

Growth was almost entirely organic — word-of-mouth and content-driven. While the core audience was still designers, the team noted that product managers, engineers, and marketers were starting to adopt the tool. However, even then the team hadn’t fully grasped why users were so eager to invite collaborators.

Fast forward to today: Figma has over 13M monthly active users, and only 1/3 are designers. The remaining 2/3 include engineers, PMs, marketers, and content creators — a full expansion into the product workflow.

On the customer side:

450K+ total customers.

1,031 enterprises spend over $100K/year, accounting for 37% of ARR.

Another 11,107 customers exceeded the $10K/year threshold, covering the remaining 63%.

95% of Fortune 500 companies use Figma.

76% of customers use 2+ products.

85% of users are outside the U.S., and non-U.S. revenue accounts for ~47% of ARR.

This IPO has naturally drawn comparisons to Canva. Using Figma’s valuation as a reference point, Canva’s IPO is now expected to exceed $100B. Canva currently has $3.3B ARR, compared to Figma’s $900M — more than 3x larger.

Their growth rates are close: Canva is growing 50% YoY, Figma 46%, but Canva is already profitable, with a much broader TAM, targeting non-designers and casual creators.