Genspark hit $50M ARR in 6 months, The AI Weight-Loss App Surpassed $160M ARR

AlphaSense ARR Hit $500M, n8n 10x revenue this year alone

Hi there, after a week's break, I am back. It’s been a busy period for the AI industry. While OpenAI’s Sora hit 1M downloads faster than ChatGPT, Reflection AI just raised $2B. And some big Revenue growth milestones:

AlphaSense ARR Hit $500M

AlphaSense is a market intelligence and business insights platform. The growth is driven by strong adoption of its AI-powered “agentic workflows.”

It now serves over 6,500 corporate customers, including heavyweights like Google, Microsoft, J.P. Morgan, Pfizer, UBS, and 88% of the S&P 100 index firms. This milestone reflects sustained momentum in enterprise use of AI-augmented research and insight delivery tools.

AlphaSense closed its latest valuation at about $4 billion following a $650 million funding round in 2024, alongside the acquisition of Tegus for $930 million to bolster its data coverage.

By March 2025, the company had already outpaced $400 million ARR, achieving 100% year-over-year enterprise adoption growth. With AI token usage up ~33% quarter over quarter and enterprise intelligence deals growing 185%, AlphaSense is doubling down on domain-specific AI as its core growth vector.

Grafana Labs ARR Hit $400M

Grafana Labs, the company behind Grafana Cloud and its observability stack, recently surpassed $400 million in annual recurring revenue (ARR) while serving more than 7,000 customers worldwide.

This milestone was announced along with a secondary transaction led by Ontario Teachers’ Pension Plan and participation from Sapphire Ventures and Tiger Global, signaling strong investor confidence in Grafana’s trajectory.

Grafana’s product suite is centered on unified observability: bringing metrics, logs, traces, synthetic monitoring, and profiling together under Grafana Cloud. It helps companies reduce complexity by enabling AI-driven dashboards, natural language query generation, anomaly detection, contextual root cause analysis, and adaptive telemetry to cut noise and cost.

Built on top of open source foundations (Grafana, Loki, Tempo, Mimir, etc.), Grafana Labs differentiates by offering managed cloud services, enterprise support, and advanced features like SLO/alerting, workflow automation, and observability for multi-cloud and distributed environments.

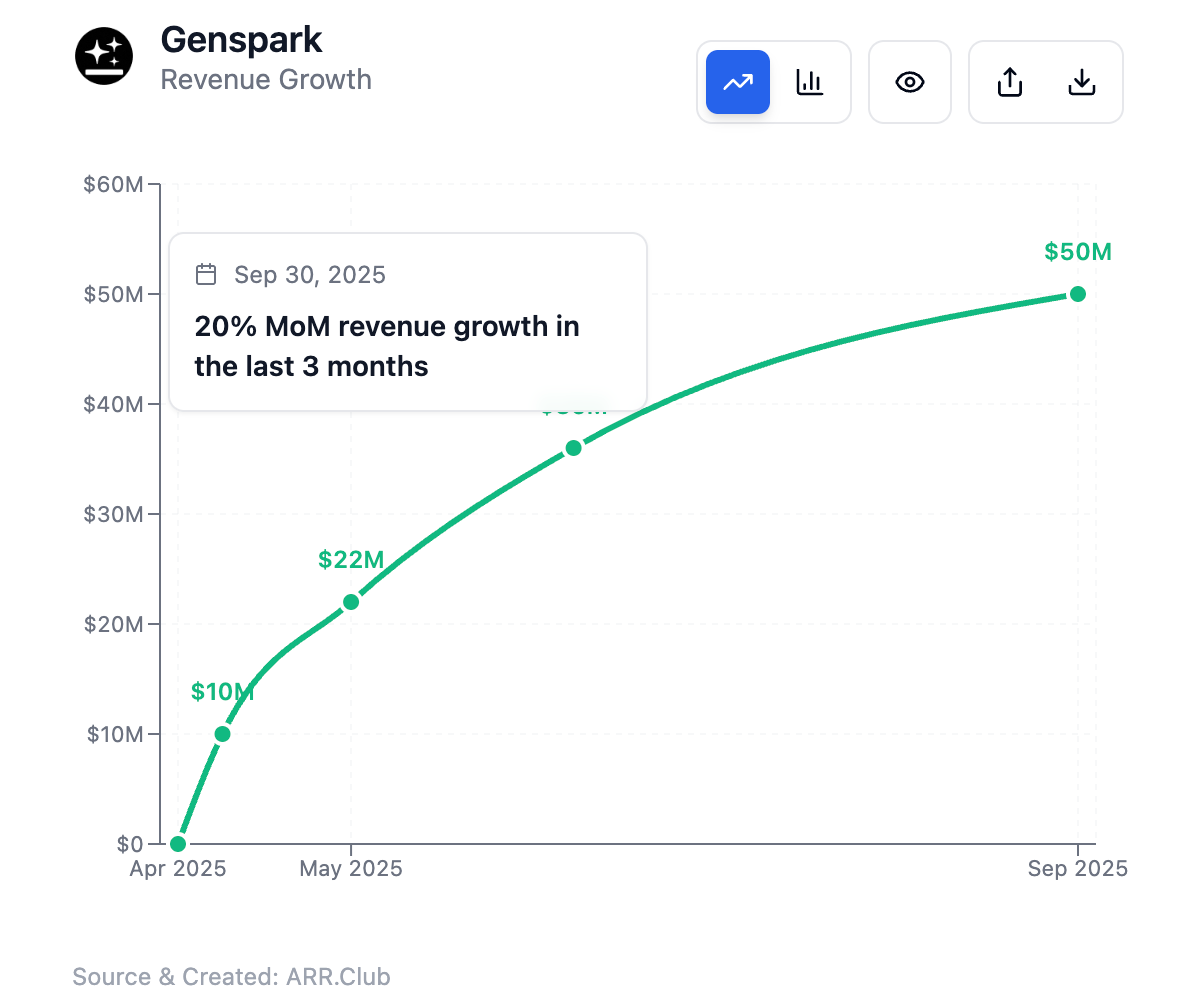

Genspark ARR(annual run rate) Hit $50M in 6 months

After hit $10M ARR in 9 days, Genspark said they surpassed $50M ARR.

Genspark’s product is positioned as a “super agent” that automates complex workflows for developers or knowledge workers—essentially acting as an autonomous AI collaborator.

CEO Eric Jing said that despite the initial launch vibe in April, Genspark has continued to grow strongly in both users and revenue:

With ~20% month-over-month revenue growth over the last three months, their annual run rate has surpassed $50M! Month‑1 paid retention is 88%-92%! Q2 net burn was under $1M!

Just the last two months, they shipped 6 major products: Genspark Photo Genius, AI Browser with on‑device free AI, Clip Genius, AI Designer, AI Developer and AI Meeting Notes.

n8n Grow 10x revenue this year alone

n8n, renowned for its AI automation, has announced a $180M SeriesC funding round, reaching a valuation of $2.5B. This is a full $1B higher than the $1.5B valuation rumored in August.

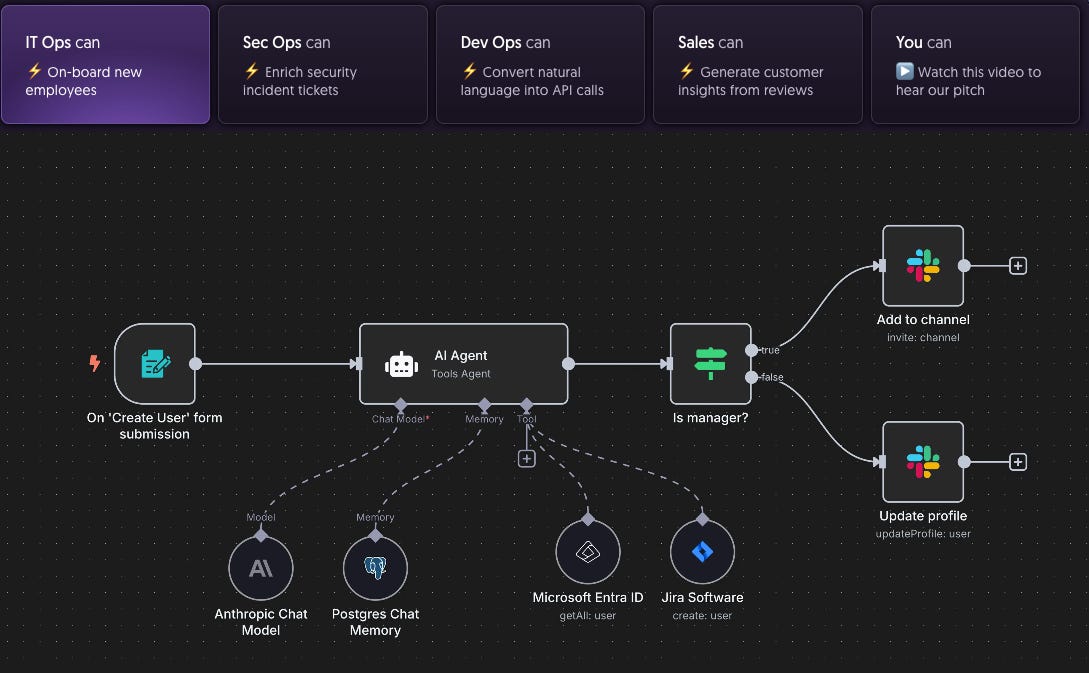

The lead investor remains Accel, as previously reported, with participation from Meritech, Redpoint, NVentures, Felicis, Sequoia, and others. In its official blog, n8n stated that the AI Agent landscape has split into two major camps:

Some platforms put everything in the hands of AI; you just write prompts and hope for the best, with the entire logic determined by the model’s interpretation. Other platforms require strict, rule-based routing, which is powerful for engineers coding each path but impractical for business users needing rapid iteration.

We’ve learned from the community that both extremes hinder business development. Pure autonomous decision-making works wonders when it functions, but its unpredictability is too high for critical business processes. Purely rule-based routing is predictable but requires more time for each change and often involves developers.

Therefore, n8n says it’s built for the reality in between: giving you flexible control over where your Agent sits on that spectrum. You choose the balance—how much autonomy to grant, how much logic to implement, and crucially, how to adjust this balance after learning what works.

But controlling this balance is just the foundation. Putting Agents into production requires two key elements: one is Orchestration, which connects Agents to actual tools and data sources, introduces human oversight when necessary, and establishes monitoring and triggers to ensure everything runs smoothly.

The other is Coordination: bringing together those who understand business needs and the builders who can implement them on the same platform for real-time collaboration.

Founder Jan Oberhauser reiterated their proven simple formula: combining AI, code, and humans in the same workflow, on the same platform. Technical builders handle the architecture, while domain experts handle configuration and optimization. This is coordination, which only succeeds when the orchestration layer is flexible enough to evolve with your needs.

n8n’s growth is extremely rapid. In a previous article, I mentioned its ARR had surpassed $40 million. Now, officially, n8n claims that this year alone, its user base has grown 6 times, and revenue has grown 10 times. They are evolving n8n from a platform into an ecosystem.

Jan Oberhauser compares n8n to Excel, which I find quite apt. He said he started n8n initially to eliminate repetitive tasks and focus on what he truly enjoys. Today, he sees a world where building with AI, enhancing one’s own capabilities with Agents, and becoming a 10x operator, like using Excel, have become basic requirements. Initially, those who knew Excel were special, but now it’s an essential skill for many positions.

The AI Weight-Loss App Surpassed $160M ARR

Meanwhile, Cal AI, an AI weight loss app created by a 17-year-old, has grown to $30M ARR business.

Surprisingly, another AI weight loss app has hit a $160M ARR. Unlike apps that rely on calorie scanning, it uses a serious AI coach to guide users toward a healthier lifestyle.