Fireworks hit $280M Revenue, 2 College Dropouts built an AI Note-taker Hit $10M+ ARR with almost no funding

Mercor is now a $10B company

Too Much Money in Silicon Valley

It’s hard not to marvel at how much money there is floating around Silicon Valley. Several startups have just announced massive funding rounds in the past few days:

Mercor officially announced a $350 million Series C funding round.

Whatnot raised $225 million in its Series F funding round.

Fireworks announced $250 million Series C.

…..

After this new round, Mercor’s valuation has jumped fivefold from its Series B to $10 billion.

In its blog, Mercor said the new funding will accelerate investment in three areas: building a larger talent network, improving its matching system, and speeding up delivery.

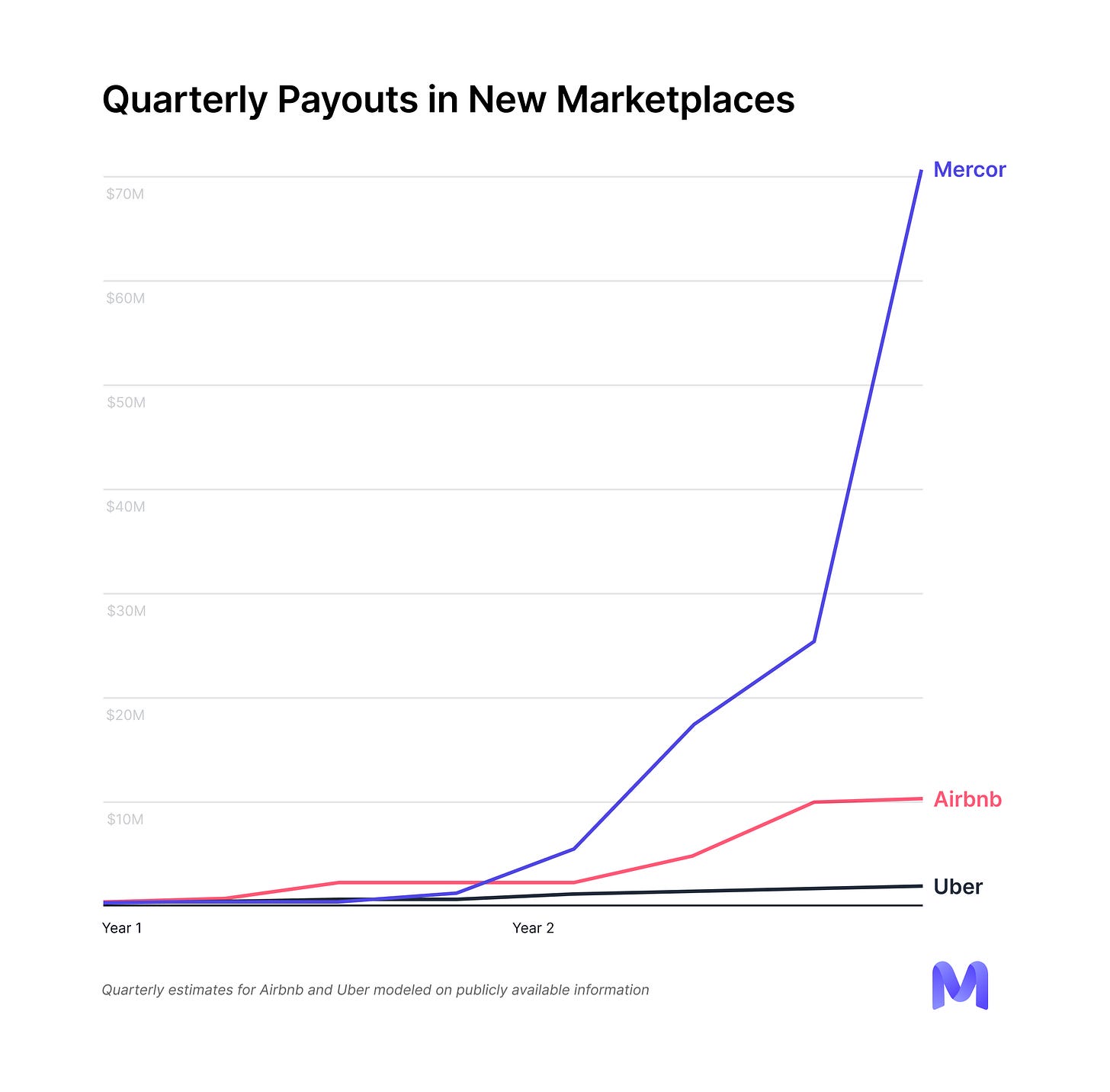

The chart that impressed me most shows how AI-era marketplaces differ from traditional ones. Mercor now has over 30,000 talent experts, and the platform already pays out more than $1.5 million per day to them.

That’s far higher than what Airbnb or Uber ever achieved. You can feel the value generated by connecting specialized intellectual talent — something that selling goods or hourly services simply can’t match.

And unlike traditional marketplaces, AI has dramatically boosted both matching quality and efficiency, making Mercor look less like a marketplace and more like an intelligent network.

Mercor’s revenue mainly comes from commissions, which currently stand at 30–35%.

After Meta’s investment in Scale AI, many enterprise customers also came to Mercor. It’s said that this partnership helped quadruple Mercor’s revenue, pushing its annualized income to $500 million.

Whatnot and the rise of live commerce

China’s livestream-commerce boom has inspired the U.S. as well. Whatnot just raised $225 million in its Series F, taking its valuation to $11.6 billion.

This year, Whatnot’s livestream GMV has surpassed $6 billion, from which it takes an 8% commission.

Fireworks: the $4 B AI Infra hit $280M Annual Revenue

Fireworks, the AI Infra has officially announced its $250 million Series C, valuing the company at $4 billion. The round was co-led by Lightspeed, Index Ventures, and Evantic.

I’ve written about Fireworks several times before. The company provides hundreds of advanced open-source models across text, image, audio, and multimodal formats. It supports fine-tuning, reinforcement learning, and model evaluation — offering up to 40× performance improvements and 8× cost reductions compared to competitors.

According to its blog post, Fireworks now serves over 10,000 enterprises, a 10× increase from its Series B, including Samsung, Uber, DoorDash, Notion, Shopify, and Upwork.

It also powers hundreds of thousands of developers building custom AI apps and now processes over 10 trillion tokens per day. Revenue has already exceeded $280 million, up from just over $100 million a few months ago — an incredible pace.

Founder Qiao Lin attributes this growth to a belief in “one-size-fits-one” AI, rather than one-size-fits-all.

Foundational models solve general problems, but the most valuable data lives inside enterprises — in user interactions, domain workflows, proprietary knowledge bases, and behavior patterns.

Fireworks helps developers use that data to fine-tune models for specific contexts, improving inference speed, cost, and quality. As users interact with those custom apps, new feedback loops continuously refine the models — every correction, ignored suggestion, or new approach strengthens both the app and the model.

This is product-model co-design: a tight data-feedback loop powered by reinforcement learning that lets companies improve their AI systems over time while optimizing for cost, speed, and quality. It’s how businesses build defensibility — and how AI begins to evolve autonomously.

As Qiao Lin puts it:

AI is the greatest business opportunity in history — but companies shouldn’t have to choose between a few tech giants. They should be able to build, own, and control their own AI infrastructure from the ground up.

The crowded AI-notes market still has room to grow: 2 College Dropouts Built an AI Note-taker Hit $10M+ ARR

There are probably hundreds of AI note-taking products worldwide. I’ve already covered more than ten of them — ranging from industry-specific tools to hardware products and infrastructure layers( A $10M+ ARR business also built by 2 college dropouts).

What surprised me is that a new entrant has emerged, reaching eight-figure ARR in just over a year, with over 20,000 new users per day. Its founders?

College students who dropped out to build it, and with almost no funding.