Clay 100× to $100M ARR in 2 years; 16-Year-Old Builds $1B AI Prediction startup in a Year

Glean ARR Hit $200M, Micro1 ARR hit $100M, Higgsfield ARR Hit $100M

Many big milestones for AI startups this week: Glean, Micro1, Higgsfield and Clay.

Glean ARR Hit $200M

Glean — the enterprise Work-AI platform that helps organizations harness AI to understand internal knowledge, automate workflows, and deliver context-aware assistance — has officially surpassed $200 million ARR, doubling from $100M just nine months earlier.

This rapid growth places Glean among the fastest-scaling pure-play enterprise-AI companies of the decade, signaling strong and accelerating enterprise adoption globally.

Glean said customers have surpassed 20 trillion tokens-per-year run rate on Glean, and it is seeing strong engagement and external recognition — company‑wide deployments more than doubled, $1M+ customers nearly tripled, users average five queries/day with 40% wDAU/wMAU.

Micro1 ARR Hits $100M

Micro1 is a fast-rising startup supplying human-curated training data and evaluation services for AI labs, has officially crossed the milestone of $100M ARR. This marks a dramatic jump from the roughly $7 million ARR reported at the start of 2025, underscoring an unusually steep growth trajectory driven by surging demand for expert human feedback in large-scale AI projects.

Micro1 offers a comprehensive “human-data engine” that helps AI labs and enterprises source, vet, and manage domain-expert human annotators and evaluators for training, fine-tuning, reinforcement learning, and evaluation of large language models or other AI systems.

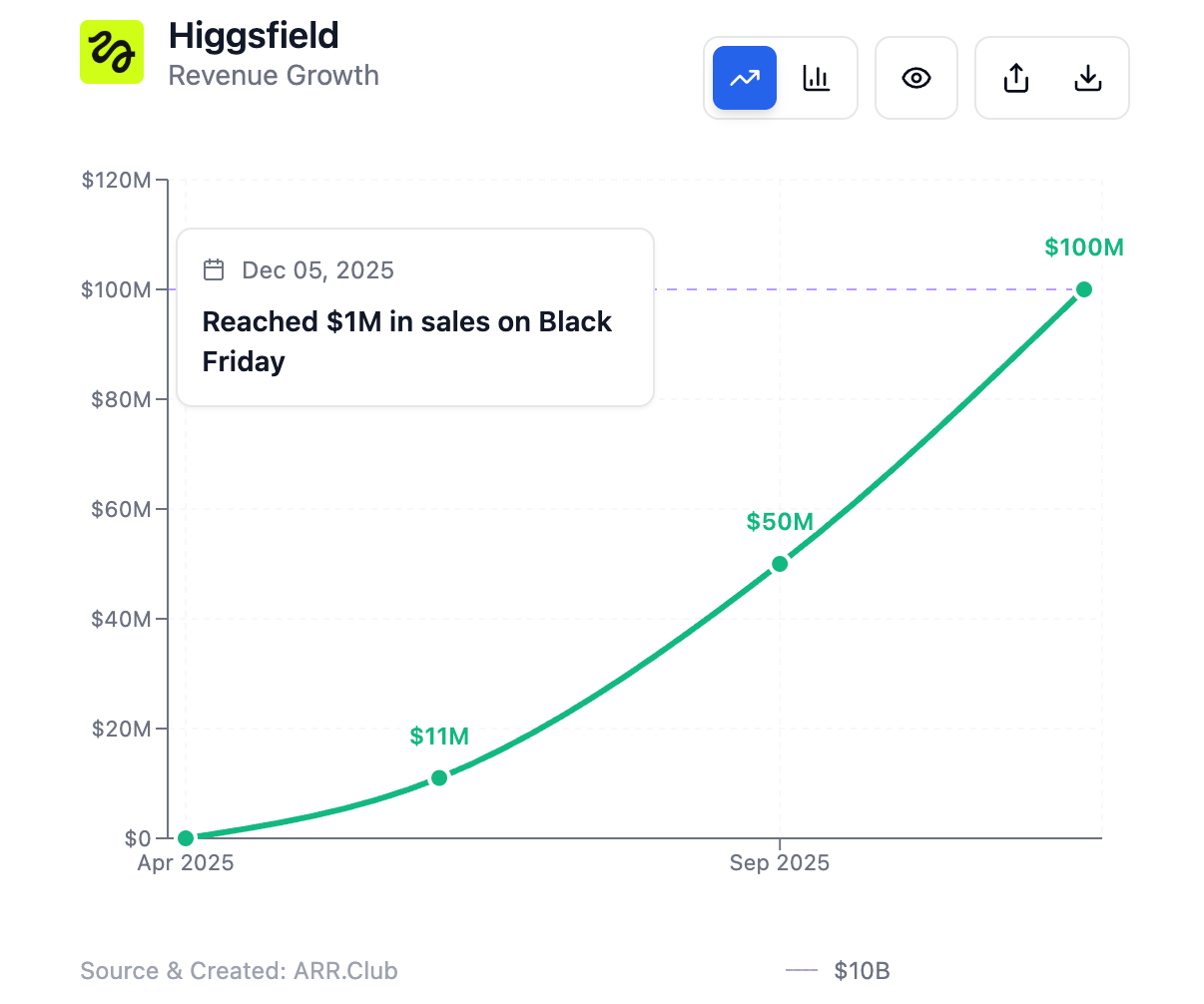

Higgsfield ARR Hit $100M

While hit $50M Run Rate 3 months ago, Higgsfield has now officially hit $100M ARR, and reached $1 million in sales on Black Friday.

Higgsfield builds “AI-powered video creation” tools that let anyone — even without video-editing skills — turn a selfie, photo, image or prompt into a short, cinematic video.

Rather than aiming at only expert video editors or wealthy production teams, Higgsfield targets ordinary creators, social-media users, marketers — basically people who want “fun, fast, shareable videos” without shooting or editing.

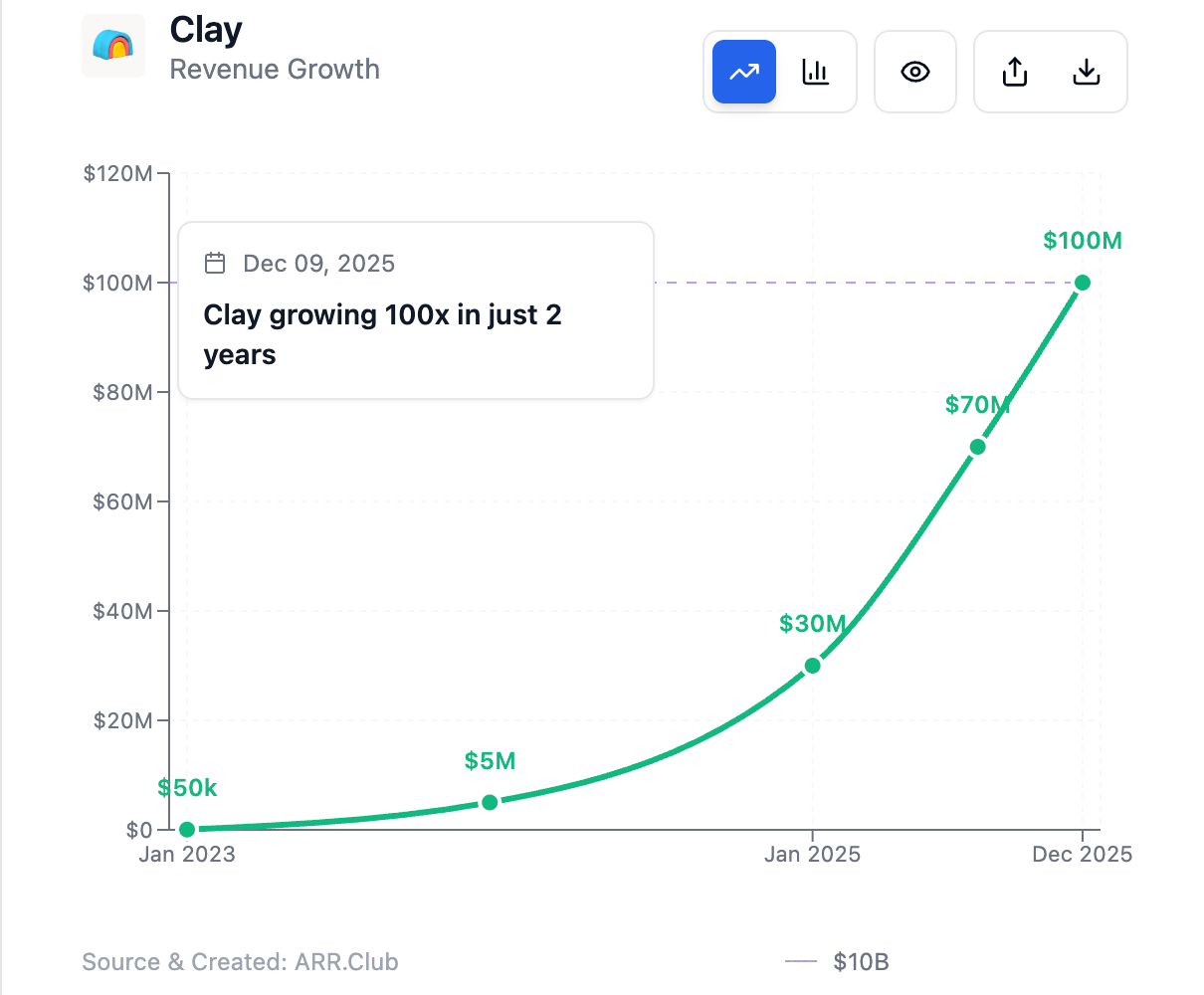

Clay 100× to $100M ARR in 2 years

Clay’s journey mirrors that of many startups: seven long years of grinding, almost shutting down, endlessly searching for PMF—until they finally found it in AI-powered sales prospecting. Once they hit PMF, growth took off like a rocket.

From there, Clay didn’t just scale; it created an entirely new AI-native function: GTM Engineering. Their valuation quickly climbed to $3.1B. And today, Clay announced that its ARR has surpassed $100M, growing 100x in just two years.

Its enterprise net revenue retention is above 200%—a phenomenal number (anything above 100% is considered elite). It means not only does every enterprise customer renew, they also double their spend on average.

Clay also claims it has never lost a single enterprise customer, and that every $1 invested into Clay yields a 15x return. As Clay’s finance head put it, the company was never an “overnight success”—its rise was built on years of work that most people never saw.

Clay’s seven-year search for PMF remains one of the most instructive startup stories I’ve seen.

The early Clay problem: not lack of market, but too many markets

Unlike many startups, Clay’s issue wasn’t the lack of a target market—it was that too many markets loved the product. HR teams said it was useful, sales teams wanted it, product engineers found value too. Everywhere they looked, someone had a use case.

That breadth made it feel like they’d struck a PMF goldmine. But this broad horizontal appeal created paralysis: they couldn’t decide which vertical to commit to, losing precious years.

It took nearly seven years of progressively narrowing their ideal customer before they finally focused on sales. Co-founder Kareem Amin once said that the problem isn’t that founders don’t know who the customer is, but that they refuse to choose. And that lack of choice leads to product confusion—what it is, what features matter, even the language you use to describe it.

Clay’s fear was simple: “Why do something smaller when we could do something bigger?” But in the end, they learned that narrowing the focus actually increases value.

Once Clay found PMF, it redefined Go-to-Market

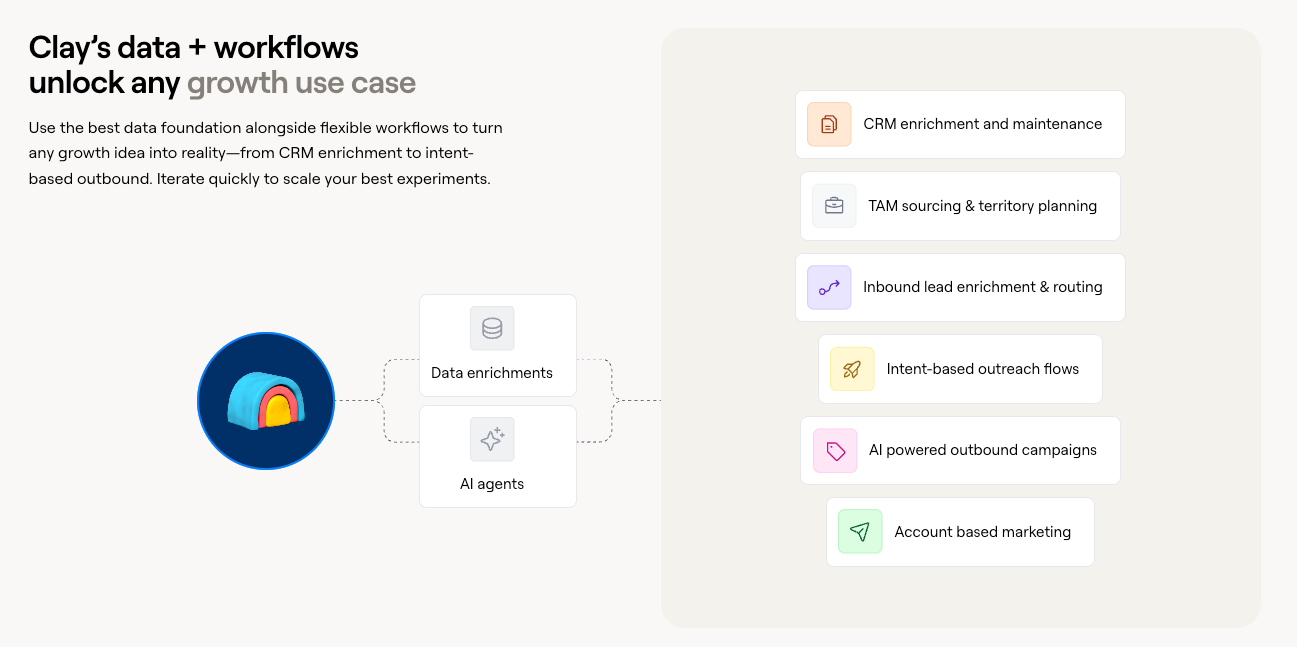

By deeply integrating data, AI, and automated workflows, Clay reinvented GTM and essentially created the new profession of GTM Engineering.

Sequoia noted that sales and marketing are fundamentally the process of finding, understanding, and engaging prospects—and Clay automates and improves every step.

Clay’s AI agents now replace much of the manual research that SDRs used to do, while their AI crawler handles unstructured SDR research automatically.

They’ve built the entire GTM stack—data sourcing, enrichment, intelligence, research, sequencing—into a single system. I’ve long believed Clay’s automation engine is one of the biggest reasons for its success.

16-Year-Old Builds $1B AI Prediction Startup in a Year

The explosive growth of Kalshi and Polymarket has pushed prediction markets back into the spotlight.

Now there’s another breakout in the prediction world—one that hit a $1B valuation in little over a year. One of its founders is a 16-year-old high school student.

Unlike Kalshi or Polymarket, it does no financial trading. Instead, it builds predictions entirely through AI agents—thousands of them. It has built a full multi-agent simulation engine that uses AI to forecast events by recreating the world itself.