Airwallex ARR Hit $1B, Binance's CZ Backs College Junior's AI Tutor in $11M Seed Round

K12 + Visual Learning = Massive Market

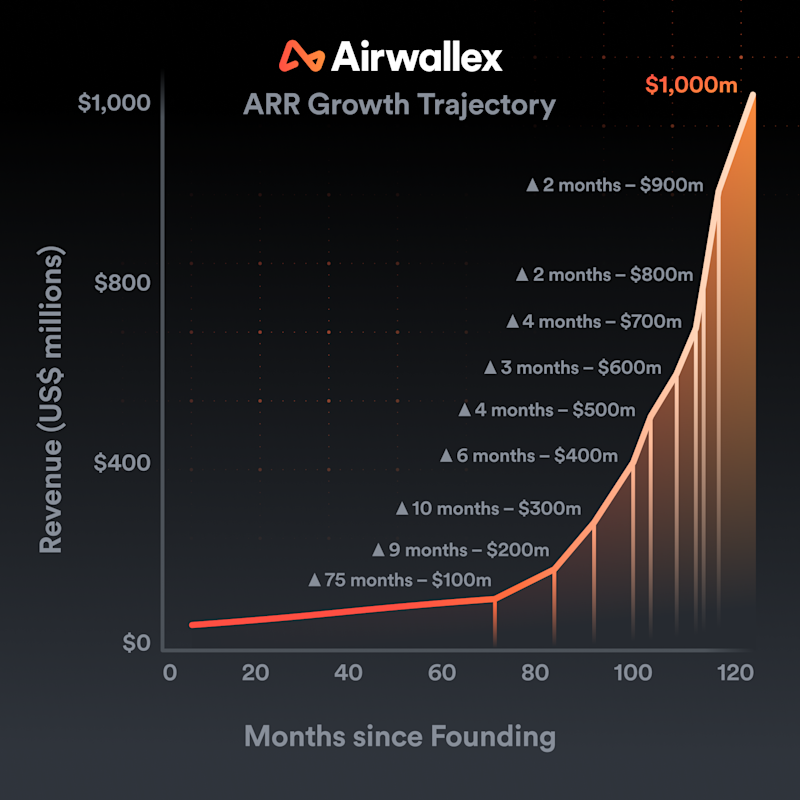

Airwallex from $500M to $1B ARR in 1+ years.

Airwallex has crossed an impressive $1 billion annualised run-rate (ARR) as of October 2025, marking a significant milestone for the global fintech platform.

The company doubled from its first $500 million in ARR—achieved over nine years—to reach the next half-billion in just over one year, reflecting a dramatic acceleration in growth.

Airwallex offers a unified financial operating system enabling businesses—especially “born-global” companies—to manage cross-border payments, multi-currency accounts, corporate cards, billing and treasury services through APIs and a proprietary infrastructure.

The growth curve steepened for a few reasons:

Growing customer adoption: The number of customers using multiple Airwallex products has doubled since last year: the clearest evidence of strong and growing product market fit. Customers typically onboard with Airwallex to solve a single need, then extend their usage across markets and product suites as they scale. That organic growth reflects deep trust and the value of a single platform that can grow with them, wherever they go.

Global-first companies are defining the new era of growth: A new generation of “born-global” businesses are accelerating economic interconnection. High-growth companies in AI and SaaS are launching into multiple markets from day one, selling, hiring, and transacting globally by design. Airwallex is uniquely positioned to power that shift.

CEO Jack Zhang said that the current growth rate of roughly 90% year on year, Airwallex is on track to double again. Geographic and product diversification, and accelerating with AI will make it to $2 billion in ARR within the next 12 months.

CZ’s first AI investment: $11M Seed for AI Education Agent

A college junior just closed an $11 million seed round—one of the largest early-stage raises ever by a student-founded startup in Silicon Valley.

The company lets anyone instantly generate personalized teaching and explainer videos with a single sentence. Positioned as an AI education agent for K12 students, the product targets the U.S. standardized test prep market (SAT, AP).

The round was led by YZi Labs, with participation from Binance founder Changpeng Zhao (CZ) and other investors. This also marks the first AI startup investment by YZi Labs, which received over 10 term sheets before choosing its final investors.