A little-known App Studio is making ~$100M a year

Ramp ARR hit $700M

Fintech is back, while Ramp, the fintech startup focused on corporate expense management, has recently achieved remarkable financial milestones. As of January 2025, it recorded an annualized revenue of $700 million.

Ramp ARR hit $700M

Ramp is a financial technology company that specializes in spend management solutions. Its primary offerings include corporate charge cards, expense management software, and accounts payable automation.

The platform aims to streamline financial operations for businesses, allowing finance teams to manage spending efficiently while reducing overhead costs. Ramp has gained popularity among startups and small companies seeking innovative ways to cut down expenses and manage their finances effectively.

As of January 2025, it recorded an annualized revenue of $700 million, significantly up from $300 million just six months prior in August 2023. Ramp has nearly doubled its valuation to $13 billion following a $150 million secondary share sale.

And Stripe just released its 2024 Annual Letter, achieved significant growth in 2024, processing $1.4 trillion in payment volume (+38% YoY), equivalent to ~1.3% of global GDP.

Key drivers include investments in AI/ML (e.g., fraud detection, checkout optimization) and vertical SaaS platforms enabling small businesses to scale. Highlights that caught my eye:

1. AI Economy:

Partnered with AI leaders (OpenAI, Anthropic, Midjourney, etc.) and startups (700+ AI agent companies launched on Stripe in 2024).

AI tools like Stripe’s Agent SDK enable autonomous commerce (e.g., voice agents managing subscriptions).

2. Vertical SaaS:

60% of U.S. small businesses use vertical SaaS (e.g., Slice for pizzerias, Jobber for home services), with 6.3% of first-year companies reaching $1M in revenue.

3. Stablecoin Revolution:

After acquiring the Bridge platform, transaction volume doubled from Q4'23 to Q4'24, with 40M monthly active wallets. Key use cases include corporate fund management (e.g., SpaceX), cross-border payments (e.g., DolarApp), and payroll (e.g., Airtm).

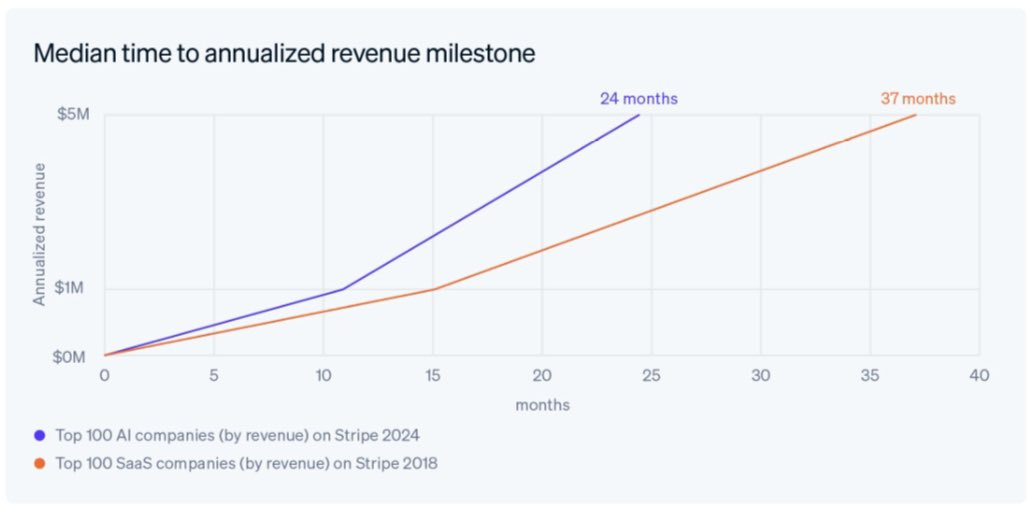

One chart showed that the median time for the top 100 AI companies to reach $5M in revenue is 24 months, compared to 37 months for SaaS companies—a full year faster. Many cases are covered in my article: 0 to $10M ARR in 1 year with 2 people: Small Teams+AI are the Future.

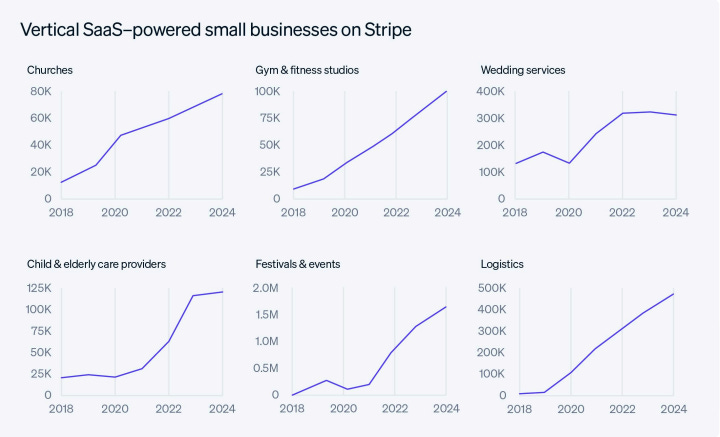

Another chart focused on vertical SaaS opportunities. For example, in the fitness space, I noticed Cal AI is now making $100K in daily revenue, said the 17-year-old founder Zach Yadegari recently.

Cal AI is an AI calorie-tracking product designed to simplify the process of monitoring food and nutritional intake. It caters to users looking for a more efficient and modern way to manage their dietary habits, primarily through image recognition.

The little-known App Studio is making ~$100M a year

In the same fitness sector, there is an App Studio little known making~ %100M a year. They are a family of about 20 active Apps on App Store with 2 main types. They are solving a lot of problems with AI.

One of its fitness apps is now making $2M in a month, and the other one of its identifier apps is making $50M in a year.