2 person startup hit $10M MRR in 2 months, here's How

And $5M monthly net profit

ARR is outdated, MRR is coming. A company in this YC batch hit $10M MRR and $5M monthly Net profit.

What shocked me is that they are a only 2-person company, founded by 20-year-old serial entrepreneurs. It is not in the AI area but in Crypto, maybe some AI+Crypto.

Market Background

In recent years, the cryptocurrency market has been undergoing a silent revolution. A defining trend has emerged:

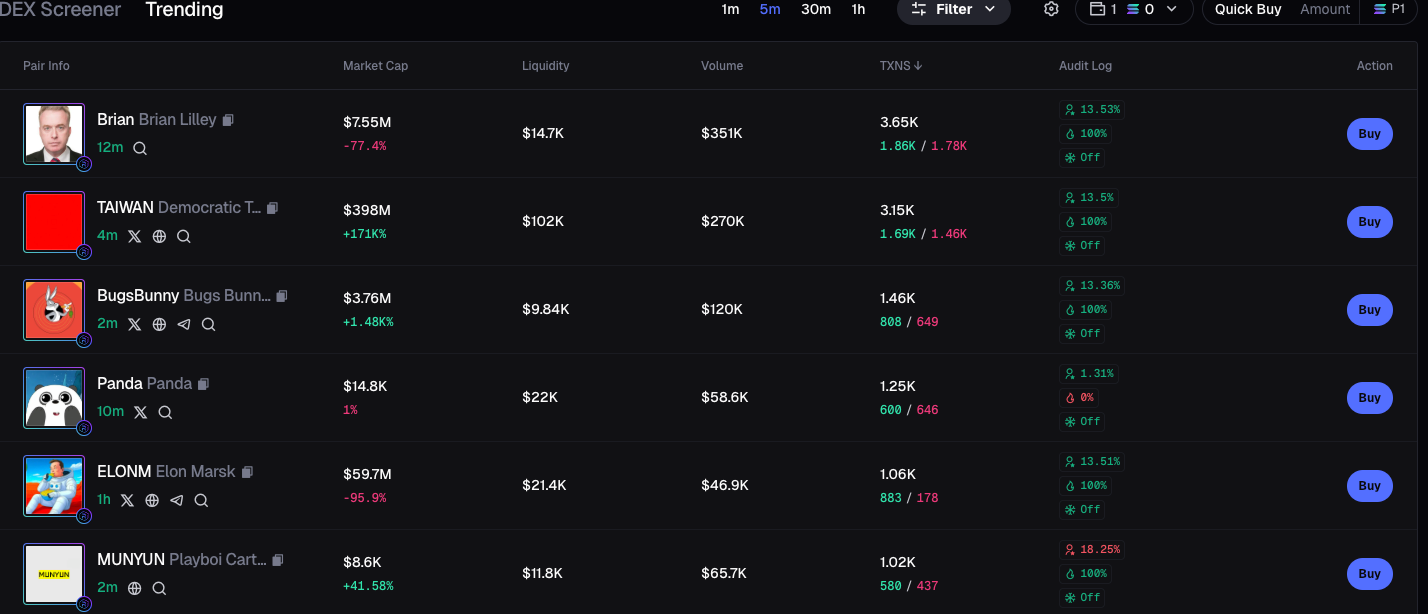

The competition among decentralized exchanges (DEXs) has evolved from mere “price wars” to an arms race of toolkits.

The dominance of centralized exchanges (CEXs) is eroding as users increasingly prioritize self-custody, lower transaction friction, and AI-powered decision-making tools.

While platforms like Uniswap disrupted order books with automated market makers (AMMs), and aggregators like Jupiter captured 60% of Solana’s trading volume, a new generation of platforms is pushing boundaries further.

These innovators are no longer content with passively aggregating liquidity; they are packaging complex features—social sentiment tracking, cross-chain interoperability, institutional-grade risk modules—into intuitive interfaces.

Some even deploy AI to predict market movements. This shift from “trade execution” to “alpha-enabling” is rewriting the rules of value distribution.

Yet beneath the surface of prosperity, undercurrents swirl. In 2024, Solana’s daily trading volume surpassed $10 billion, with memecoins driving 70% of its volatility. Such growth has thrust DeFi into regulatory crosshairs. The SEC’s lawsuits against decentralized protocols, recurring $100M+ cross-chain bridge hacks, and the proliferation of low-quality projects have left investors balancing high returns against existential risks.

In this climate, a unique breed of platforms has captured attention: those blending CEX-like fluency with DeFi’s permissionless ethos, offering professional-grade leverage tools while democratizing access to social-driven insights.

A “new species” born in this era of acceleration. It aggregates multi-chain liquidity, integrates social signals and automated strategies, and claims to solve entrenched issues like Miner Extractable Value (MEV) with near-geekish technical precision.

I did a deep dive into how it did.